As rent explodes nationally, Miami tops the charts

As rent explodes nationally, Miami tops the charts

Trending

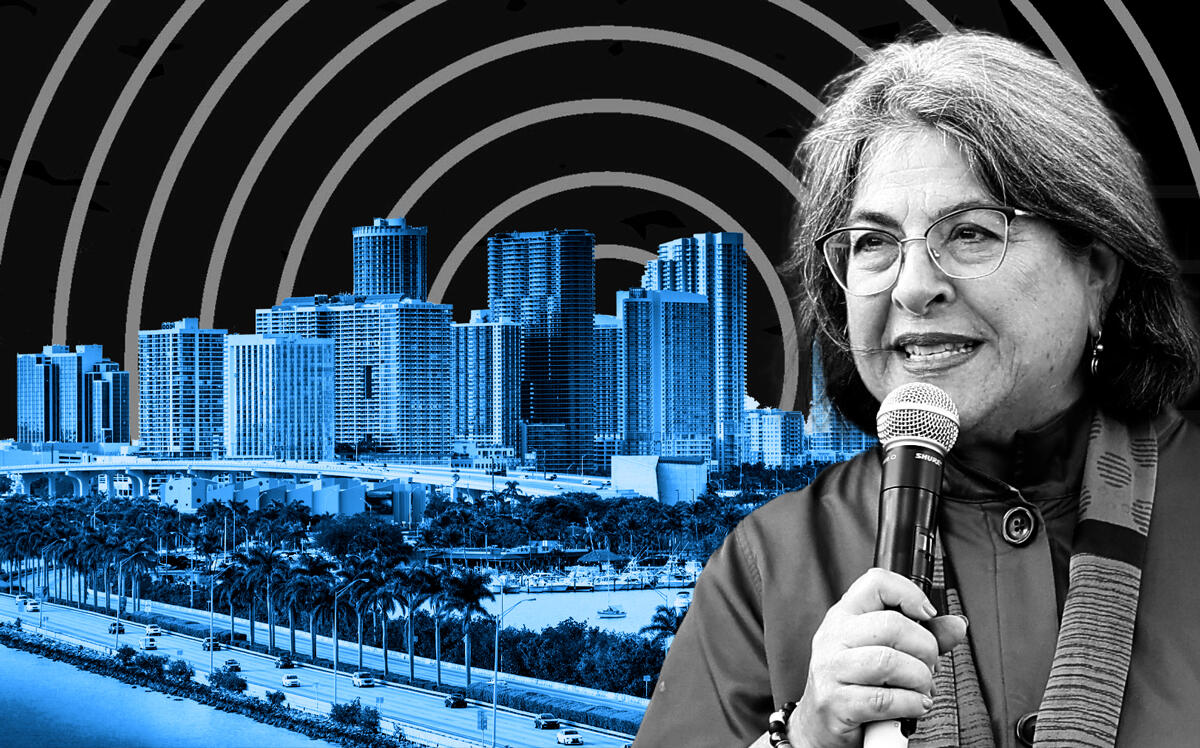

Miami leads nation with 58% rent spike during the pandemic

Sun Belt cities overtook Big Tech hubs in rate hikes in past two years, report shows

Miami led the U.S. in rent hikes during the pandemic.

Miami’s median apartment rent skyrocketed 58 percent to $2,988 per month since March 2020, according to a newly released report from Realtor.com.

Median rents increased nationwide by 19.3 percent to a new high of $1,807, with Sun Belt cities seeing many of the biggest gains. The trend follows migration to these markets since the onset of work-from-home shift, with many residents leaving pricier Big Tech hubs.

Over the past two years, Miami became a magnet for techies, as well as hedge funders and venture capitalists, quickly earning the city the moniker of “Silicon Valley of the South” or “Wall Street of the South.”

After Miami, the city of Riverside, California posted the biggest rent hike of 48.2 percent to $2,687 a month; followed by Tampa, with a 45.8 percent jump to $2,114. Two more Florida cities saw some of the biggest rent increases, with Orlando spiking 34.7 percent to $1,886 a month, and Jacksonville 29.2 percent to $1,580 per month.

Other cities with the 10 biggest hikes are mostly in the Sun Belt. They are Memphis (41.4 percent); Las Vegas (34.4 percent); New Orleans (33.3 percent); Richmond, Virginia (30 percent); and Phoenix (30 percent).

Big Tech cities represented five of the 10 markets with the slightest upticks, although tech hubs remained pricey.

San Jose rents barely moved, rising 0.1 percent, but the city still has the highest median monthly rent among the 50 largest U.S. metros at $3,075, according to the report.

San Francisco monthly rents rose 0.3 percent, reaching $2,982, although residents can find savings in smaller units. Rents declined 13 percent for studios and 3.3 percent for one-bedroom apartments.

Other Big Tech markets with small gains are Washington, D.C., (5.1 percent); Seattle (6.1 percent); and Chicago (6.7 percent).

Miami outpacing the nation comes days after Miami-Dade County Mayor Daniella Levine Cava officially declared a housing crisis. The county is ready to dole out $41 million of federal funds for rental assistance. The pot of money is expected to dry out by early 2023 or sooner.

Miami-Dade is targeting the most vulnerable, those who earn 80 percent or less of the area median income. A preference would be given to those earning 50 percent or less, or who already are undergoing the eviction process.

Read more

As rent explodes nationally, Miami tops the charts

As rent explodes nationally, Miami tops the charts

Miami becomes least affordable housing market in the US

Miami becomes least affordable housing market in the US

Gen Z renters flood big cities, driving market activity

Gen Z renters flood big cities, driving market activity

Miamians generally are in a much tighter squeeze than their counterparts in other metros because of the area’s long lagging incomes.The county’s median income is $61,000, compared to $80,000 in Los Angeles County and $81,700 in New York, according to the Department of Housing and Urban Development, which is expected to update the data soon.

In February, a RealtyHop report ranked Miami as the least affordable market in the nation, based on the percentage of income paid for homeownership costs.

Covid-19 prompted a homebuying spree across the U.S., but renting remained popular, with the expectation for continued apartment demand. The recent increase in mortgage rates and high home prices still will push some would-be buyers into renting, according to Realtor.com.

During the past two years, rates for one-bedroom apartments nationwide went up 17.9 percent and 21.9 percent for two-bedroom units, according to the report. By contrast, studios went up 12.6 percent.

Yet the data hints to a cooling of rent growth. It has moderated nationwide for the second consecutive month, year-over-year, according to a statement from Danielle Hale, Realtor.com’s chief economist.

“We expect cooling to continue over time,” she said, “but the jury is still out on whether rent growth will hit single-digits by the end of 2022.”