Trending

“Signs of slowing”: South Florida apartment rent growth cools in third quarter amid construction boom

Investment sales so far this year hit a low last seen in 2014, a report shows

South Florida’s apartment rent growth slowed in the third quarter, amid a construction boom that led to higher vacancies, a recently released report shows.

Developers completed 13,388 apartments in South Florida in the first three quarters of the year, more than the 13,210 units finished in all of last year, according to data from brokerage Lee & Associates. The new supply tempered the market, slowing rent growth, while high borrowing costs thwarted the investment sales frenzy of 2021 and early last year.

“There are signs of slowing across a lot of the major metrics,” said Todd Cohen, principal of Lee & Associates South Florida. “But slowing from what? This market was beyond on fire. A cool off is necessary for the health of our market in general.”

Net absorption of 7,780 apartments through the third quarter lagged behind net deliveries of 13,388 units, according to Lee’s data. As a result, occupancy declined. The vacancy rate in the third quarter rose to 5.4 percent from 4.6 percent in the third quarter of last year.

While the Federal Reserve’s interest rate hikes since last year have thwarted some planned multifamily projects, developers with financing in hand are continuing to build. In Miami-Dade County, 16,260 units are expected to be completed by the end of 2024, with 4,364 of those finished this year, according to a Colliers data issued early last month.

Generally, a building boom coupled with a lagging absorption could spell vacancies and reduced rents. But faced with high mortgage rates and a lack of housing inventory, would-be homebuyers are expected to drive rental demand, Cohen said. Florida’s business-friendly climate and lack of a state income tax will maintain the tri-county region’s reputation as a magnet for new residents, he said.

“While I don’t think anything can match what was happening from 2021 to early 2022 in terms of torrid pace” of the market,” he said, “it still would be strong, and I think it still will be.”

Digging in on rents

South Florida’s average monthly asking rent was $2,121 in the third quarter, Lee’s report shows. That’s a hair over the $2,126 rent in the previous quarter and a 1 percent increase from the $2,099 rent in the third quarter of last year.

“The rent crisis as we knew it, being defined as rapid year-over-year increases, that has mostly gone away,” said Ken Johnson, an economist and Florida Atlantic University professor.

Johnson is part of a partnership, which includes University of Alabama professor Bernie Waller and Florida Gulf Coast University professor Shelton Weeks, that produces a nationwide rent index.

According to their Waller, Weeks and Johnson Index, South Florida rents in September increased 0.17 percent from the previous month and 2.7 percent, year-over-year. That’s a much calmer growth compared with September of last year, when rents increased 0.5 percent from the previous month and 18.8 percent year-over-year, according to the index.

“It’s a huge difference,” Johnson said. “But what hasn’t happened is rents have not gone down, and they are very unlikely to.”

In fact, Johnson predicts that South Florida is in for a “prolonged period of housing affordability issues” due to incomes not keeping up with rent increases.

According to the three professors, for an average South Florida household to spend no more than 30 percent of its gross income on housing costs, it needs to earn $111,780 annually. (Thirty percent is the maximum federal threshold before a household is deemed cost burdened.)

Yet, the Department of Housing and Urban Development pegs Miami-Dade’s area median income at $74,700; Broward County’s at $88,500; and Palm Beach County’s at $98,300.

Deals drop

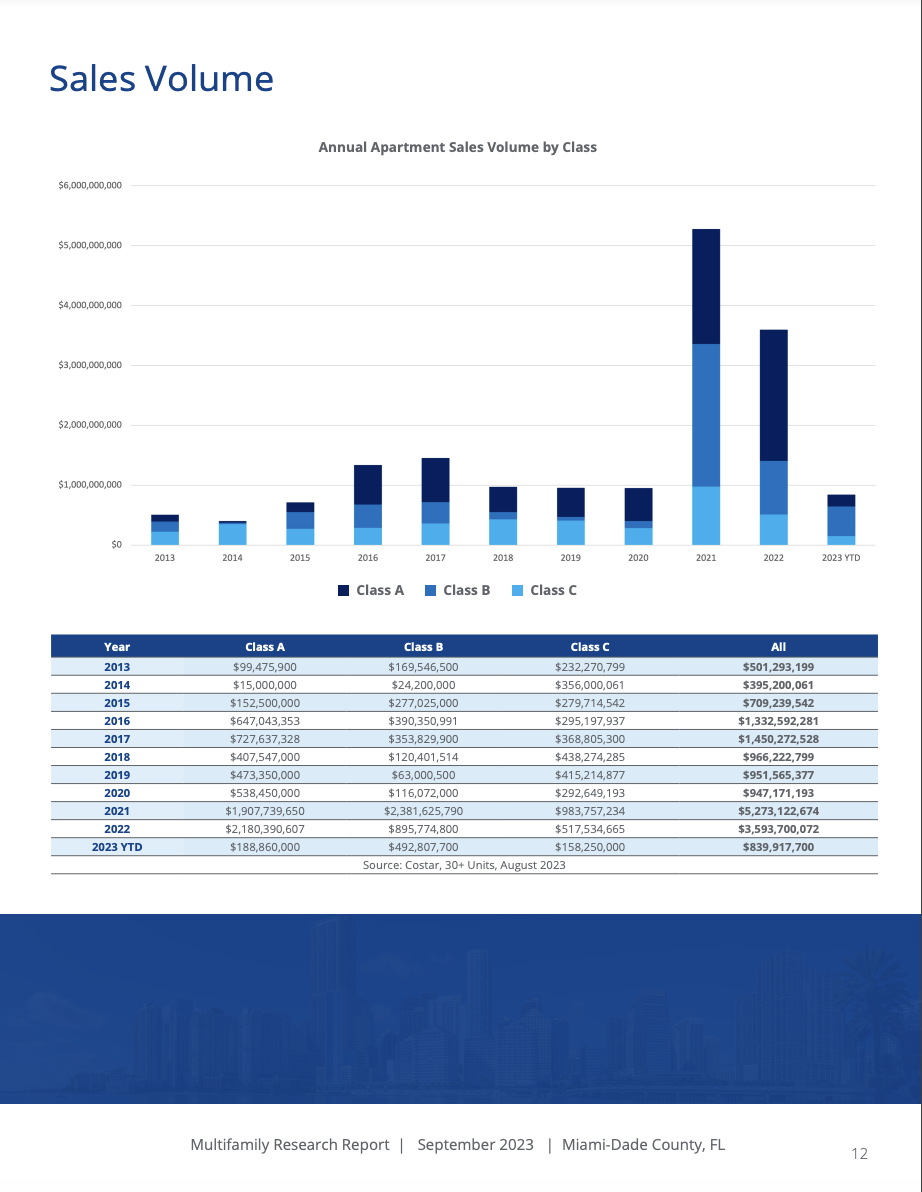

In the first three quarters of this year, the volume of multifamily investment sales reached a low that was last experienced in 2014.

So far this year, 17 deals closed for a combined $1.4 billion, much less than the 73 deals for $8.2 billion recorded last year, and 138 deals for $8.8 billion in 2021, according to a Newmark report. Annual deal volume has ranged from $2.8 billion to $8.8 billion since 2015, meaning this year’s volume is only comparable to 2014 when 46 deals closed for a combined $1.4 billion.

The nosedive is largely due to higher borrowing costs, though some real estate investors have found workarounds. Players still in the game are firms with capitalized discretionary funds that allow them to have less exposure to financing or steer clear from borrowing altogether.

Through its $728 million investment Fund X, Praedium Group bought the 348-unit Manor Lantana complex at 861 Water Tower Way in Lantana for $138 million in June.

Others that take out financing either assume sellers’ notes or turn to Freddie Mac. In August, Harbor Group International paid $75 million for the Pine Ridge complex at 6200 Wallis Road near West Palm Beach. Harbor assumed the seller’s $37.2 million floating-rate debt and bought a cap, limiting the interest rate to 5 percent.