Fiduciary to investors: Funds in Nightingale projects “misappropriated”

Fiduciary to investors: Funds in Nightingale projects “misappropriated”

Trending

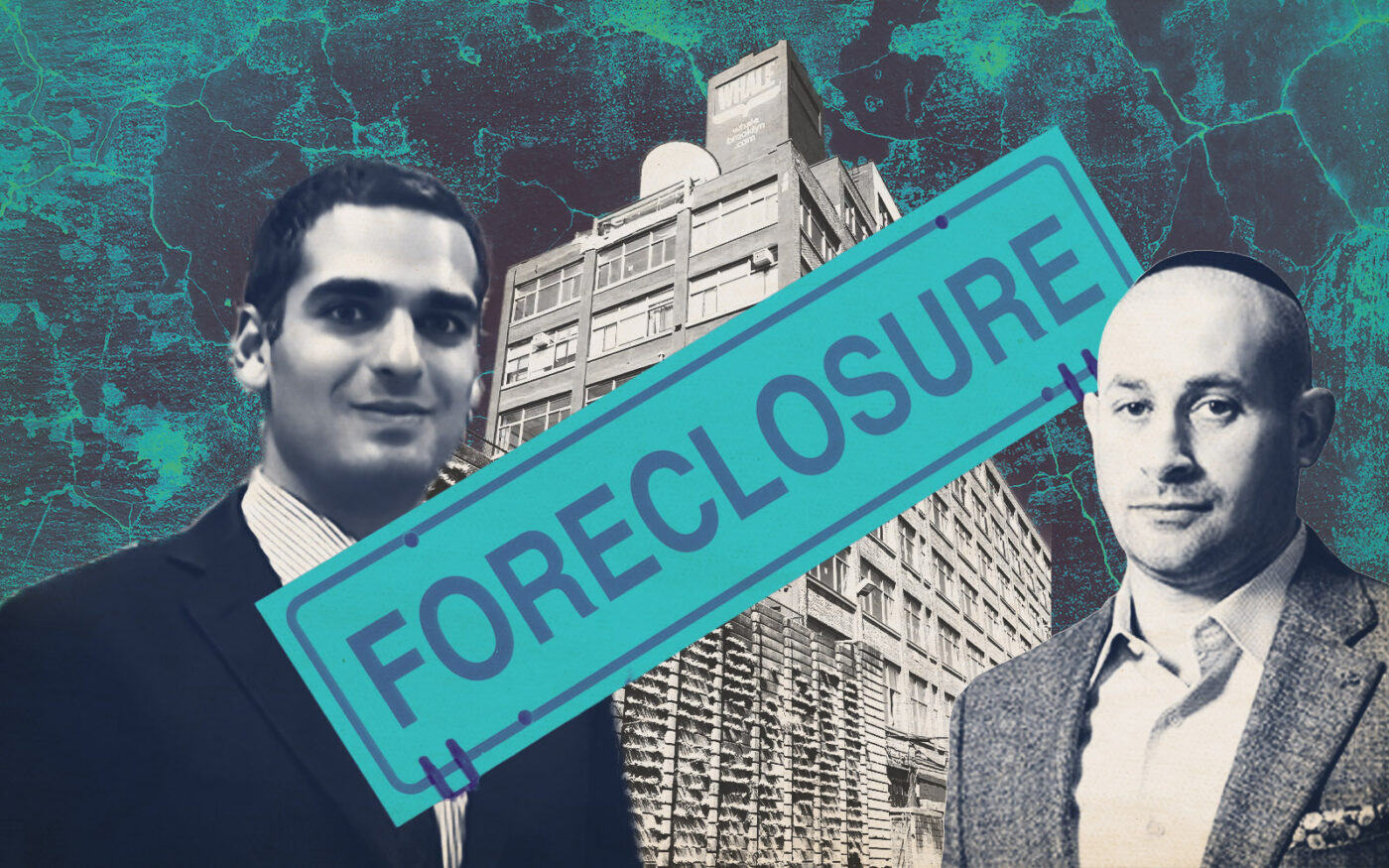

Capstone forecloses on Nightingale’s Whale Building

Submits winning bid in auction for interests in Sunset Park property

Nightingale Properties has lost another prized asset.

Joshua Zamir’s Capstone Equities acquired the 500,000-square-foot Whale Building in Brooklyn’s Sunset Park after entering the winning bid at a foreclosure auction this month.

Capstone acquired the debt on the former Whale Oil Company headquarters at 14 53rd Street from TPG this year after Nightingale defaulted. Capstone initiated a foreclosure and in August entered a bid using its existing debt to acquire interests in the property.

The firm closed on the purchase last Friday and is now leasing the seven-story property, according to Justin Adelipour of Capstone. Property records show a $41.2 million sale.

Greg Corbin of Northgate Real Estate Group and Aaron Jungreis of Rosewood Realty Group marketed the foreclosure auction.

Adelipour said Capstone expects to pursue flexible industrial and entertainment tenants. Existing tenants will be able to remain. Capstone has started leasing available space at the massive building, which a listing boasts is “redefining office excellence in Brooklyn.”

The Whale Building is one of the many Nightingale assets to fall into distress. The New York-based firm was thrust into the spotlight this summer when its CEO, Elie Schwartz, was accused of misappropriating millions of dollars from crowdfunding investors. An independent manager for the investors alleges that Schwartz used some of the money for personal expenditures. The manager is trying to determine where all the money went.

Nightingale has yet to respond to the allegations.

Lenders have since initiated foreclosures on other Nightingale properties, including 111 Wall Street, 300 Lafayette in Soho and office property in Philadelphia.

The company recently defaulted on a loan on a 15-story office building in Midtown East. Nightingale’s partner Intervest has purchased the loan on 300 Lafayette Street, staving off foreclosure.

The Whale Building was one of Nightingale’s key assets. The company bought the property from Madison Realty Capital for $84 million in 2020. Madison kept a 25 percent stake but later sold it to Nightingale, court records show.

Nightingale planned to convert the space into a creative office. It assumed an $88 million loan that Madison had secured from TPG. But the space was never leased up; it was only 27 percent occupied as of October. Nightingale fell into default and Capstone acquired the loans in May from TPG.

Nightingale sued both TPG and Capstone, alleging that TPG offered it a chance to buy its debt for $60 million — a nearly $20 million discount from the balance — but breached the agreement. Nightingale claimed TPG refused to let it hire Cushman & Wakefield brokers who were essential to closing the deal. A judge dismissed Nightingale’s allegations.

Nightingale also sued Capstone, alleging it misused confidential information to acquire its debt. Capstone said Nightingale simply couldn’t come up with the money and is seeking to play the role of spoiler. A judge dismissed Nightingale’s tortious interference claims, but allowed its claim of unfair competition to go forward.

Schwartz is continuing to fight. He recently asked the court for a motion to substitute the entity that is suing Capstone because Capstone now has control of that entity after the UCC foreclosure.

Schwartz and Nightingale’s attorney did not return requests for comment.

Read more

Fiduciary to investors: Funds in Nightingale projects “misappropriated”

Fiduciary to investors: Funds in Nightingale projects “misappropriated”

Nightingale faces foreclosure on Brooklyn’s Whale Building

Nightingale faces foreclosure on Brooklyn’s Whale Building

Tortilla producer nabs 30K sf at Nightingale’s Whale building

Tortilla producer nabs 30K sf at Nightingale’s Whale building