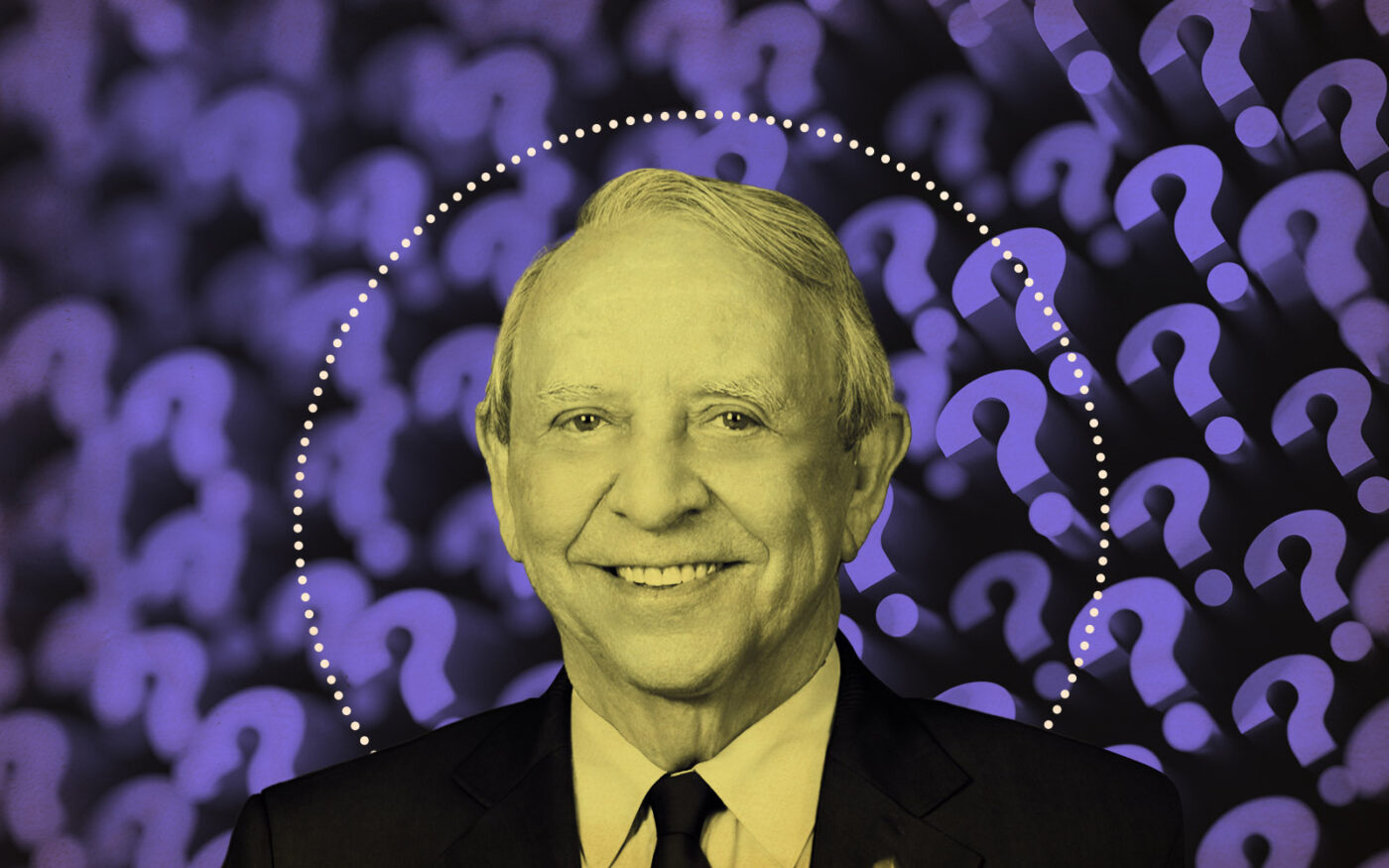

Meet Silver Star Properties’ ousted chairman and CEO Allen Hartman

Meet Silver Star Properties’ ousted chairman and CEO Allen Hartman

Trending

How Gerald Haddock plans to dig Silver Star Properties out of a hole

Sued former CEO, forced to file bankruptcy, staying the course on self-storage pivot

Silver Star Properties has had more than its fair share of troubles lately. Gerald Haddock, the firm’s co-CEO, wants to set the record straight.

The Houston-based commercial real estate firm grabbed attention in June when it told shareholders it planned to shift its nearly 7 million-square-foot portfolio away from office and retail and toward self-storage. Amid bankruptcies, executive turnover and lawsuits against its former CEO, the firm has been steadily offloading office buildings as part of that pivot.

Haddock, who also serves as the firm’s executive chairman, was previously CEO of Fort Worth-based Crescent Real Estate Equities and is president of Haddock Investments. He also sat on the board of Meritage Homes.

Jack Thompkins and Jim Still, along with Haddock, form Silver Star’s executive committee.

As you transition to co-CEO, why are you staying on as executive chairman?

Haddock: I was asked to by the executive committee. We agreed that it would be in the best interest of the company to have me as both. We’ve got a lot of talent in this executive committee, and the best way to use that is to make sure I’ve got a position in communication, direction and execution, along with the CEO status. It’s an integration policy between the executive committee and the operations of the company. Part of what the executive committee wanted me to do was to jump in here and make sure we’re able to continue the mission.

Do you mean the pivot to self-storage?

Haddock: Yes, in part.

Are you still bullish on the pivot?

Haddock: I think we’ve got an opportunity in the industry, despite slight bumps in the road and twists and turns. Everything’s working pretty well. We’re getting out of certain situations. We’re selling assets, and we’re going to be in a position of exiting bankruptcy in the not-too-distant future with a significant amount of cash to redeploy. Within 12 months or so, we’re going to find some good assets as the interest rates come down, and I don’t think we’re going to see an adjustment in interest rates until mid-2024. We’re gonna see this inflation come to a screeching halt. But, at least in real estate, it’s a question of the direction of the curve.

What’s the company’s plan with bankruptcy reorganization?

Haddock: I don’t think we did a good job of really explaining this bankruptcy. It gets factored into the equation the wrong way. We’re going to come out of this with the ability to invest about $370 million. Don’t hold me to the numbers, but it’s going to be a significant amount of leverage. We will be one of the few companies with that much capital that can bleed into the market with financing and get a portfolio started in self-storage. The only way we could get where we are today, due to Hartman’s meddling, was to file for Chapter 11 reorganization. He filed these lis pendens and claimed an interest in properties that Silver Star owns, and that stopped our ability to sell the assets. So part of our damage claims against Hartman rest on the fact that we lost money and suffered delays, interest costs, legal costs and bankruptcy. To make our shareholders whole, we have to sue him and his organizations to recover the properties we couldn’t sell. We got into bankruptcy for the purpose of getting relief under the special provisions that get the liens released, which the bankruptcy judge in Delaware agreed with.

So, one of the lawsuits against Hartman is over?

Yes, the judgment just came down. Hartman threw in the white flag. We’ve gotten an agreed judgment signed and stipulated by his companies saying that they do not have an interest in the properties that he was previously claiming an interest in. That’s why we got into bankruptcy, to be able to get this judgment and to get relief in the process to allow us to continue selling at better-than-expected prices, and finish the pivot with the money to invest in self-storage. It was a very successful judgment.

Is there a relationship now with Hartman?

Haddock: It’s business litigation. Unfortunately, as is the case with anything hostile the last few years, there’s going to be litigation. If I saw him on the street, we’d shake hands. We disagree. We had sessions — long, round-the-clock negotiations trying to make this a total separation, but we just could not get this worked out in a satisfactory fashion.

What caused it to go sour?

Haddock: He was demanding that we give him five properties in exchange for his ownership in the company, which means his efforts worked to extract value from other shareholders. So I continued fighting for the shareholders. I just couldn’t make those deals. Hartman was not able to do what we used to call “greenmail transactions,” where someone would come in, buy a block of stock, threaten to take over, and the company would have to buy it out at a premium. Those can’t be done anymore, but that was what he tried, so I put a stop to it. Since he was still on the board of Silver Star, we had to take action to oust him from his executive position as executive chairman and move forward.

An accusation you made that stuck out was that Hartman’s religious and political preoccupations lead to mismanagement. Can you elaborate on that?

Haddock: Those are relevant because it got in the way of the business, company time and productivity. He was also influencing some employees; we’ve had several complaints about some practices I’d rather not go into. There’s a multitude of factors. The issue certainly wasn’t that he’s a Christian. I’m a Christian, but I don’t necessarily always practice it at the office. There’s nothing negative about how somebody wants to do it, but if I try to influence somebody else, then it can create problems. You have to take steps to avoid that. He had strong political and religious views, and those have been recorded in a lot of publications. It was not the biggest driving force in itself for his ousting, but at what point does the straw break the camel’s back?

Read more

Meet Silver Star Properties’ ousted chairman and CEO Allen Hartman

Meet Silver Star Properties’ ousted chairman and CEO Allen Hartman

Silver Star chairman accuses former CEO Allen Hartman of mismanagement, unauthorized borrowing

Silver Star chairman accuses former CEO Allen Hartman of mismanagement, unauthorized borrowing

Silver Star shoots more accusations at former CEO Allen Hartman

Silver Star shoots more accusations at former CEO Allen Hartman