Blackstone, Rialto's $1.2B bid wins Signature CRE loan deal

Blackstone, Rialto's $1.2B bid wins Signature CRE loan deal

Trending

Blackstone, partners look to flip $1.8B of Signature loans

Joint venture with Rialto, pension fund awarded stake last month

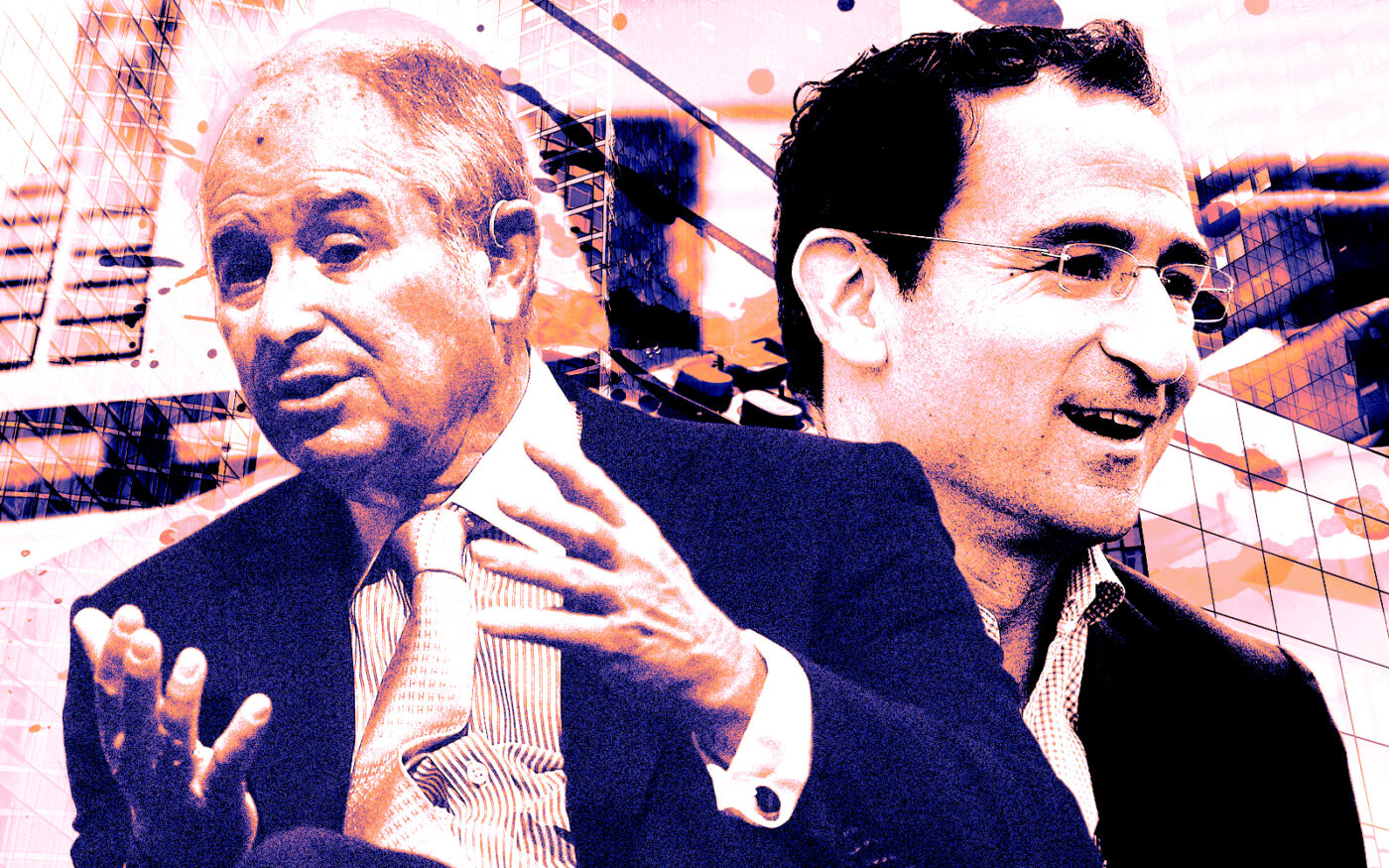

From left: Blackstone’s Stephen Schwarzman and Jon Gray (Getty, Blackstone)

A Blackstone-led venture is looking to sell commercial property loans made by Signature Bank, weeks after the investment giant and its partners bought a stake in the loan pool.

The venture with Rialto Capital and Canada Pension Plan Investment Board are marketing $1.8 billion in performing loans, people familiar with the matter told Bloomberg. The loans are largely backed by apartment buildings.

JLL is marketing the loans. The brokerage also advised Blackstone and its partners on the December deal in which it picked up a 20 percent stake of Signature loans.

The Federal Deposit Insurance Corporation last month awarded a stake in Signature’s $17 billion commercial real estate loan pool to two Blackstone affiliates, Blackstone Real Estate Debt Strategies and BREIT, along with its partners. The venture bid $1.2 billion for a 20 percent stake in the joint venture that holds the failed bank’s commercial debt; the FDIC retained an 80 percent interest and provided financing equal to 50 percent of the venture’s value.

The loan book contains 2,600 mortgages on retail, market-rate multifamily and office properties. Ninety percent of the loans are fixed-rate, according to the Blackstone venture.

When it acquired the stake, Blackstone took over as lead asset manager on the debt, while Rialto was tasked with servicing the loans. What happens next to the portfolio will depend on how the latest sales process shakes out.

Read more

Blackstone, Rialto's $1.2B bid wins Signature CRE loan deal

Blackstone, Rialto's $1.2B bid wins Signature CRE loan deal

Brookfield’s protest on Signature loan sale peters out

Brookfield’s protest on Signature loan sale peters out

Related, Community Preservation Corp win stake in Signature rent-stabilized loans

Related, Community Preservation Corp win stake in Signature rent-stabilized loans

The FDIC and Blackstone declined to comment to Bloomberg, while CPPIB, Rialto and JLL didn’t respond to requests from the outlet.

Related Fund Management and two nonprofits won another closely watched slice of Signature’s rent-stabilized loans. The award drew the ire of Brookfield Property Group, warned the FDIC it would protest losing out to a lower bid. But its reaction has petered out as Brookfield hasn’t challenged the award and doesn’t appear to be planning any legal action, according to the Commercial Observer.

— Holden Walter-Warner