Trending

Highline launches $350M distressed commercial real estate fund

Fund will target capital-hungry owners of office, retail, multifamily, and industrial properties in the Southeast

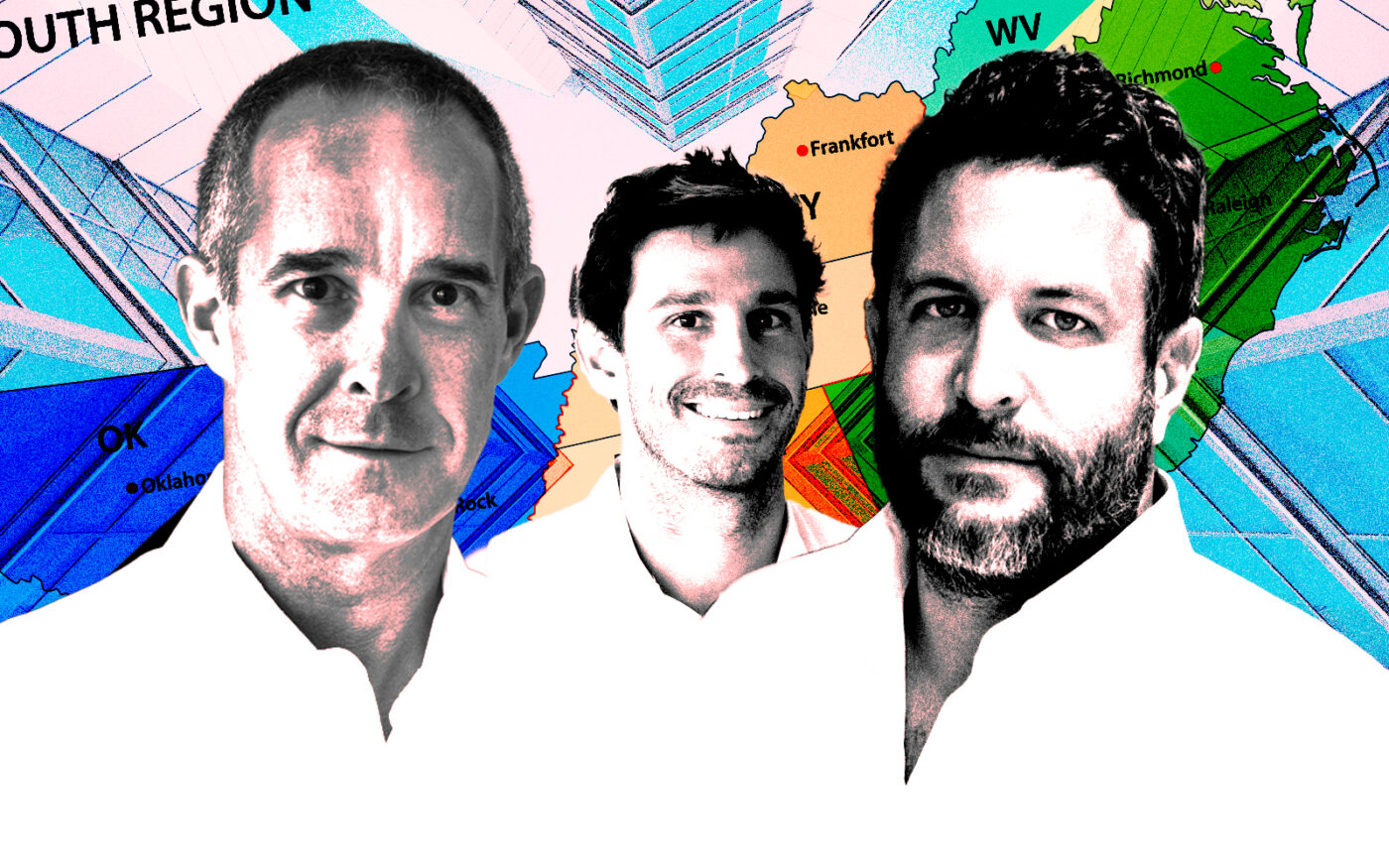

From left: Highline Real Estate Capital’s David Moret, Matt Papunen and David Milgram (Getty, Highline Real Estate Capital)

Miami-based Highline Real Estate Capital launched a $350 million investment fund that will target owners of distressed commercial real estate in the Southeast.

Through its new Highline Real Estate Fund 1, L.P., the firm will provide equity and debt financing to commercial property owners struggling to sell or finance office, retail, multifamily and industrial properties, as well as acquire properties.

“We have extensive, direct operating histories in office and retail, and so, those types of investments we would buy directly, as well as with other partners,” David Moret, principal of Highline, told The Real Deal. He expects Highline to make industrial and multifamily property investments with a partner, he added.

Multiple interest rate hikes by the Federal Reserve since March 2022 have flattened the volume of commercial property sales in recent months. Higher borrowing costs have lowered bids to buy commercial properties, which many property owners have resisted.

“There is a meaningful bid-ask spread in the [commercial real estate] market, which is why, depending on which [statistic] you use, transaction volume is down 70 percent off peak,” Moret said.

“This is the same playbook we’ve seen in past cycles,” he added. “You have an exuberant market, then you have a major shift … We are all kind of waiting for capitulation.”

Highline Real Estate Fund 1 will deploy as much as $75 million of discretional capital commitments, $100 million of joint-venture commitments with other funds, and $175 million of debt financing.

Formed in 2016, Highline has purchased, improved, and sold multiple commercial real estate properties under the leadership of Moret, principal Matt Papunen, and partner David Milgram.

Moret spent 20 years at CREC Real Estate in Florida, as a partner and head of the firm’s acquisition and investment group. Papunen was a managing director of Lennar Corp. subsidiary Rialto Capital Management and led acquisitions there. Milgram is a former vice president of the Sterling Organization, focusing on retail.

The trio has long targeted South Florida, and while they expect to allocate part of Highline Real Estate Fund 1 to properties in the tri-county region, they also are hunting for opportunities in other parts of the Southeast.

“We really like other growth markets, like Orlando, Tampa and Atlanta, the Carolinas, almost equally as much,” Moret said. “In our markets in Florida and particularly South Florida, the fundamentals are so strong that, even for assets that are impaired from a capital-stack perspective, there’s a lot of tailwinds.”

Another real estate investment fund similar to Highline’s launched in South Florida this year. Arnaud Karsenti’s Miami-based 13th Floor Investments launched the $300 million fund aimed at opportunities in growing markets nationwide, as well as distress in South Florida and elsewhere.