Trending

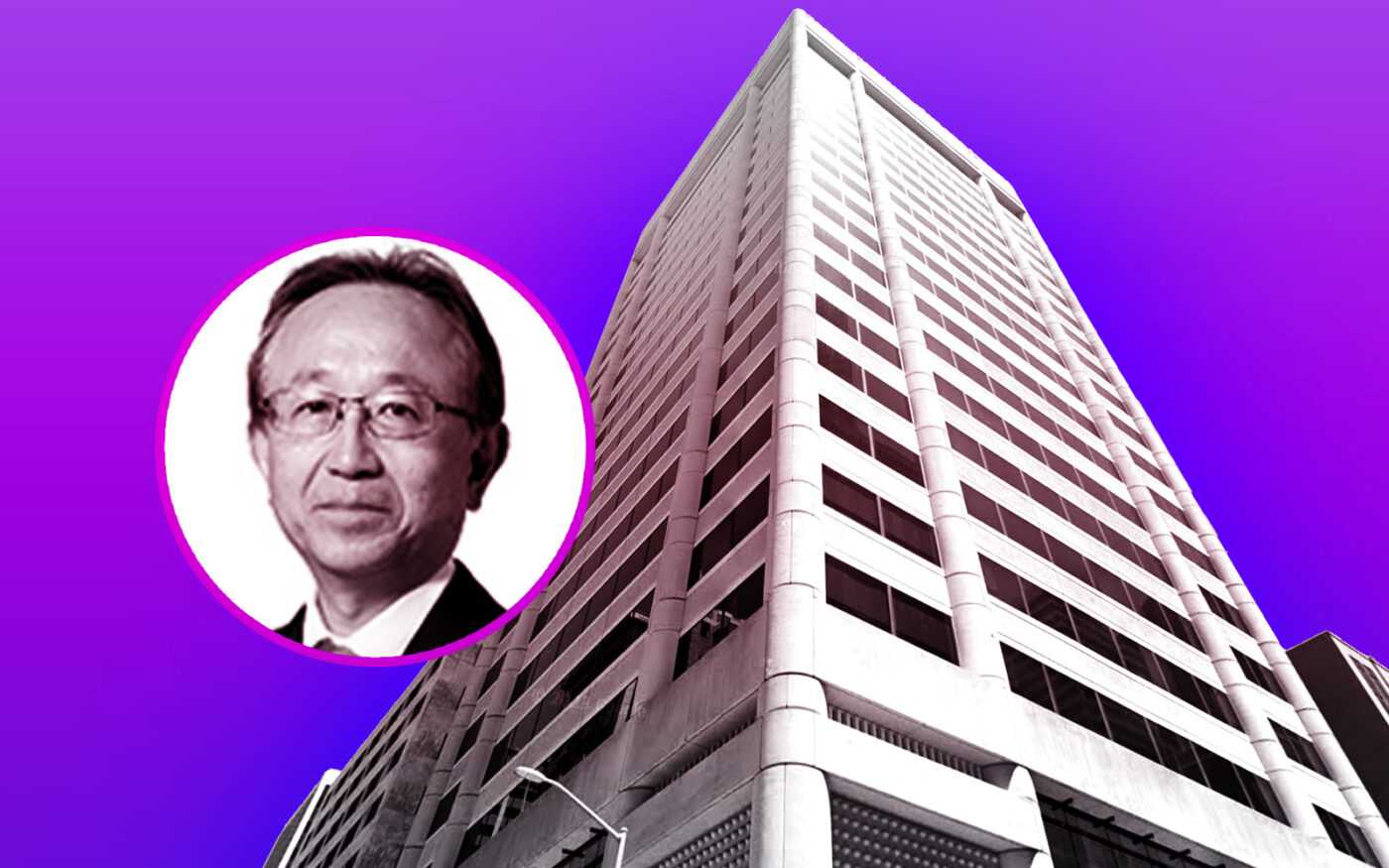

Mitsubishi UFJ to sell SF office building at expected 80% discount

Property with 22 stories was valued at $300M in 2019, but now stands 75% vacant

Mitsubishi UFJ Financial Group has listed a San Francisco office tower once valued at $300 million, but now expected to generate offers at about 80 percent less.

The U.S. unit of the Tokyo-based bank has put its 22-story glass-and-stone tower at 350 California Street in the Financial District up for sale, the Wall Street Journal reported.

The building was valued at $300 million in 2019. Bids are expected to come in from $60 million, commercial real-estate brokers say.

Before the pandemic, California Street was home to some of the world’s most valuable commercial real estate. Now, in the era of remote work, the city’s office vacancy has jumped to a record 32.7 percent, more than seven times the rate before the pandemic.

Some of the city’s most noted corporate tenants, from Salesforce to Meta Platforms, have sublet offices, flooding the market with square footage.

The plunge in office workers has slammed the Financial District, leading restaurants, stores and other small businesses to lay off employees or close shop.

In the current market, it’s hard to know what office buildings in San Francisco’s financial district are worth, because transactions have practically dried up, according to the Journal.

A sale of 350 California may establish a new benchmark.

“We’re all really on the edge of our seats to see the first office trade in San Francisco,” J.D. Lumpkin, executive managing director at real estate services firm Cushman & Wakefield, told the newspaper.

The 297,600-square-foot office tower at 350 California, which CBRE is marketing, faces specific challenges.

The tower, built in 1976, is now 75 percent vacant because the primary tenant, Union Bank, has mostly moved out.

The unfilled space represents a large liability compared to before the pandemic, when investors would often pay a premium for empty offices because it meant a chance to raise rents.

Any buyer of 350 California is expected to have to spend another $50 million on interior spaces and more to lure new tenants. Extras such as rooftop decks and spa-quality fitness centers are now standard in premium buildings commanding the highest rents.

In 2021, the owner tried to sell the office tower, but pulled the listing after bids failed to exceed $180 million, or 60 percent of its estimated 2019 value, according to unidentified sources.

Regardless of the building’s issues, a sale as low as the bids some brokers expect would be bad news for office owners in other U.S. cities too, Mark Fawer, a partner in the real estate practice group at law firm Greenspoon Marder, told the Journal.

“This could be seen as a bellwether for the value destruction in the urban office market nationally,” he said, “especially those markets that are more technology and financial services-centric.”

— Dana Bartholomew