San Jose building leased to eBay enters special servicing

San Jose building leased to eBay enters special servicing

Trending

Adam Neumann defaults on San Jose office building loan

Former WeWork CEO's family office secured $31M debt in 2021

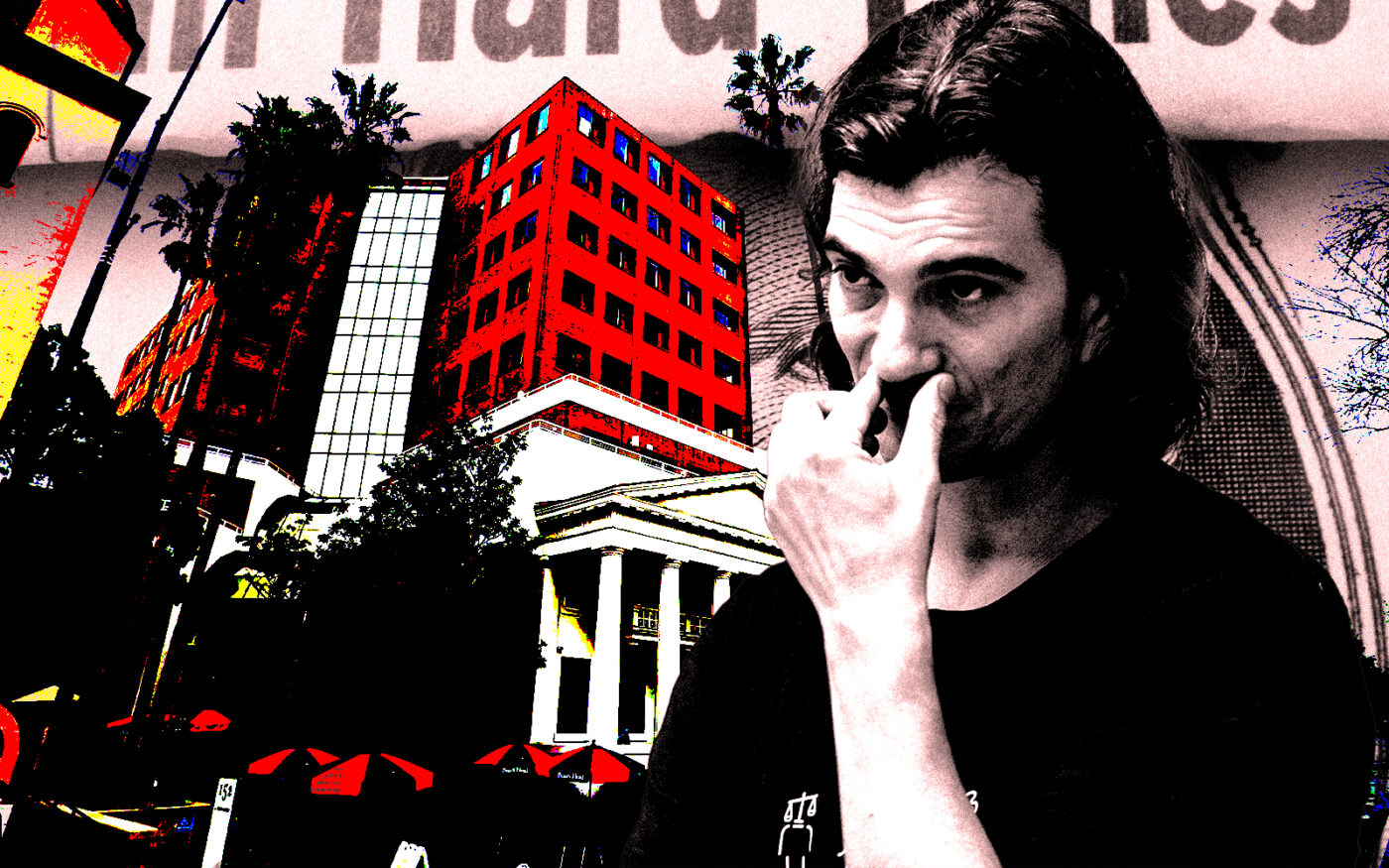

A photo illustration of former WeWork CEO Adam Neumann and 152 North 3rd Street in San Jose (Getty, Google Maps)

An office building in San Jose tied to former WeWork CEO Adam Neumann is in default, according to data collected by Morningstar. The default comes as the city’s office market continues to stagnate.

The $31 million loan, which was securitized into a collateralized loan obligation, on the building at 152 North 3rd Street was issued by Rialto Capital Management in 2021. It is set to mature in August 2024.

The borrower on the property is Nazare Asset Management, Neumann’s private family office, according to Morningstar data. According to property records, the building has been tied to Neumann since 2019.

A signatory on the LLC that owns the property is Max Fink, who is head of strategy for Neumann’s company Flow and Neumann’s family office, according to LinkedIn and California Secretary of State records.

The last payment received was on May 24, according to Morningstar, and there are 12 out of 36 payments remaining. The loan had an interest rate of 5.5 percent.

The building is 131,000 square feet and has 61,000 square feet of co-working space, according to a marketing brochure by brokerage CBRE. The building is offering direct leases at $3.95 per square foot.

Neumann co-founded WeWork, a hip co-working company, in 2010. The company experienced meteoric growth in number of locations but suffered major cutbacks during the pandemic. By the end of last year, it had accumulated losses of $16.2 billion.

Last year, Neumann announced he was starting a company akin to WeWork, but for residential real estate called Flow. One arm of Flow has already purchased apartment complexes across the country. It’s unclear whether the property was transferred to parent Flow.

Collateralized loans are typically short-term, floating-rate debt used for acquisitions and are larger replaced by a longer-term, more permanent loan. Cash flow usually isn’t the leading indicator of performance of these types of loans, and this particular one had an interest and carry reserve fund at closing, used to make up the difference between debt service and cash flow until the property starts generating enough income to cover the debt service.

While cash flow usually isn’t an indicator of performance for these loans, that seems to be the case here.

“I can see that the carry reserve has fallen to $21,000, so I suspect that this is simply a cash flow issue and the reserve designed to cover the difference has dwindled to almost nothing,” David Putro, head of CRE analytics at Morningstar, said.

Another San Jose office building recently entered special servicing. A 540,000-square-foot building that is fully leased to eBay went into default in May. The owner took out an $88 million CMBS loan from Germany-based Deutsche Bank and had $51 million remaining on the loan.

Read more

San Jose building leased to eBay enters special servicing

San Jose building leased to eBay enters special servicing

Big tech names move the office needle in Silicon Valley

Big tech names move the office needle in Silicon Valley

Bay Area’s office market is good, but for how long?

Bay Area’s office market is good, but for how long?

San Jose’s office market continues to face stagnation, and has one of the fastest downward momentums in Silicon Valley. The availability rate for the Downtown area stands at 28 percent, while the rate for Class A buildings is 37 percent, according to a second-quarter report by CBRE. The average asking rent is $4.34, which is well below smaller markets that have seen increased activity from big tech companies.