Texas’ Keller Williams wins back executive after Twitter dustup

Texas’ Keller Williams wins back executive after Twitter dustup

Trending

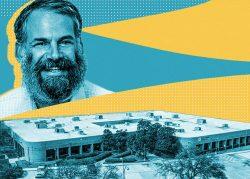

NIMBYs throw a wrench in Dallas-Fort Worth’s multifamily investment boom

Despite skyrocketing demand for rentals, some developers are avoiding North Texas altogether because of backlash

Developers aiming to tap growing demand for multifamily housing in Texas are facing increased opposition from residents opposed to higher density living.

Some companies are choosing to avoid North Texas altogether amid the backlash, even as demand soars, according to Bisnow.

Opposition by so-called NIMBYs (not-in-my-backyard groups) is just one challenge among many, including the rising cost of land and building materials in addition to kinks in supply chains.

“It’s one of the hardest challenges we face as developers,” said Tim Harris, vice president of multifamily development for Rosewood Development.

When building his landmark Heritage Creekside, a 1,300-unit multifamily, mixed-use project in Plano, Harris says his company made several concessions to pacify resident opposition, including building retail before there were enough residents to justify the investment.

“It was really important to the neighborhood that we got some restaurants,” he told Bisnow. “We decided we would do it first, even though that might not have been the business-savvy decision.”

For Rosewood, garnering support from the surrounding community in the early stages of development was half the battle in the entitlement process.

Read more

Texas’ Keller Williams wins back executive after Twitter dustup

Texas’ Keller Williams wins back executive after Twitter dustup

Dallas medical building bought for $7M by Florida-based Savlan Capital

Dallas medical building bought for $7M by Florida-based Savlan Capital

“You can’t put the genie back in the bottle,” said Christina Day, director of planning for the city of Plano. “You only get one chance to make a good first impression on your project, so it’s critically important that people hear about your project from you. If they hear about it from somebody else, you’ve lost control of the narrative.”

In December, a mixed-use project on the largest undeveloped tract of land, which had plans for up to 700 multifamily units, 427 retirement housing units and 90 townhome units, was met with 534 pieces of correspondence, more than 70 percent of which were in opposition.

Less than 5 percent of the land remains developed today.

In an effort to ease tensions between residents and developers, some companies are focusing more on mixed-use projects than traditional multifamily, said Mark Allen, senior vice president in the Multifamily Services group at Colliers. Increased sales tax revenue is a useful incentive in calming NIMBY outrage.

“Cities as a whole have to be more malleable in terms of rethinking their zoning,” he said. “We are getting a person moving to DFW once every three to five minutes, so [multifamily development] is kind of inevitable. If a particular municipality won’t go for it, then the next one will.”

In northern Dallas suburbs, the issue of dense development has become increasingly politicized, says Angela Hunt, a land use and zoning attorney with Munsch Hardt Kopf & Harr and a former Dallas City Council member.

“It’s a balance, because on the one hand the elected officials want to effectively represent their constituencies, and their constituencies may be opposed to multifamily development,” she said.

“[The debate over multifamily] definitely has a chilling effect on site selection,” she said.

The momentum of NIMBY opposition has had little to no effect on investors looking to sink money into Dallas-Fort Worth’s housing market. The area led the nation in multifamily investment last year, with close to $28B in total sales, according to CBRE.

[Bisnow] – Maddy Sperling