Ranking Houston’s top resi brokers in 2023

Ranking Houston’s top resi brokers in 2023

Trending

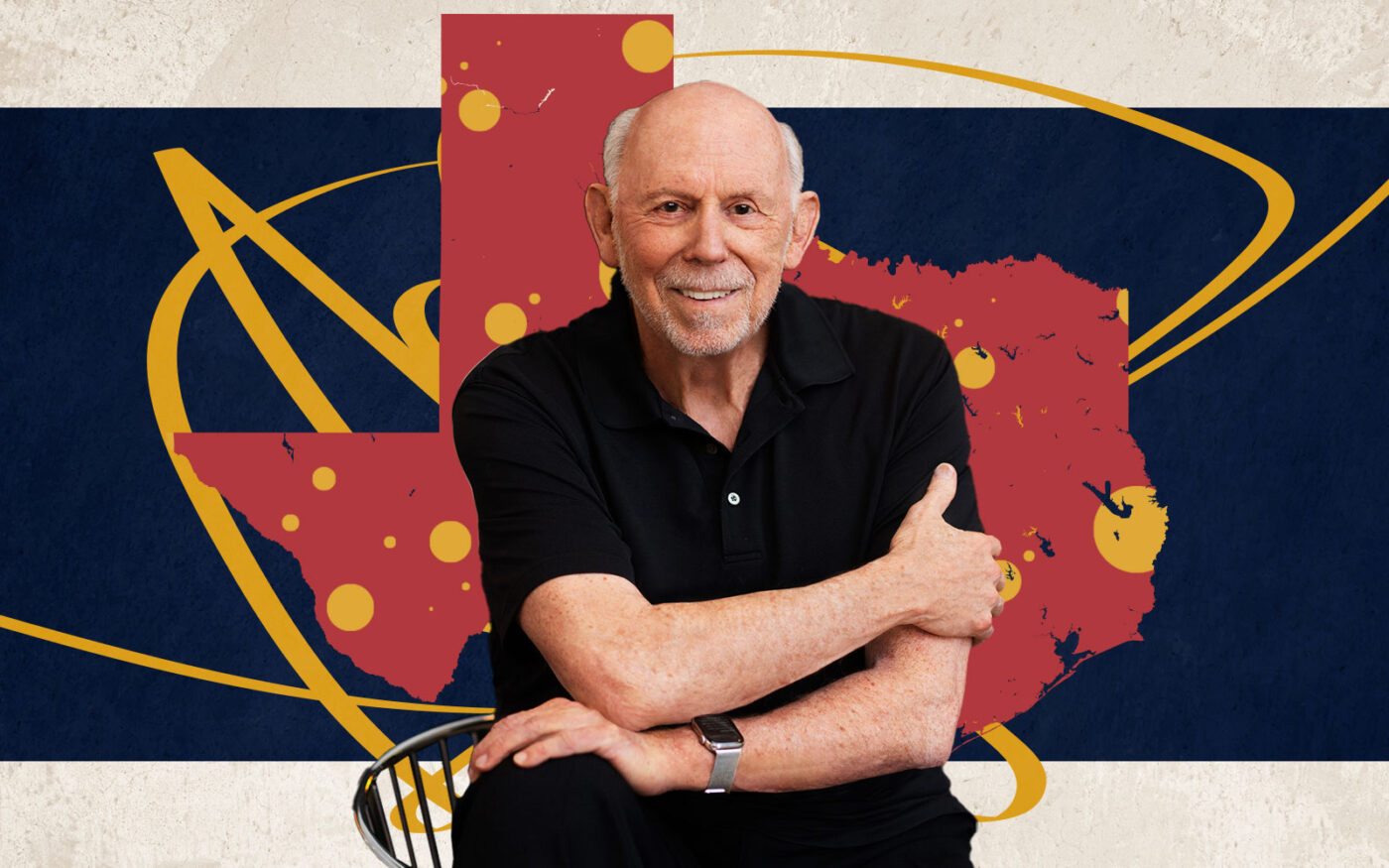

Texas’ most prolific broker thinks NAR lawsuits could turn MLS into “Wild West”

HomesUSA founder Ben Caballero discusses changes to NAR, selling $2 billion of homes

Ben Caballero broke records for selling 16 homes a day and becoming the first individual agent to sell $1 billion and $2 billion of houses in a year.

Caballero is the founder of HomesUSA, a platform that manages MLS postings for homebuilders across Texas. Caballero started the company in 2007, and is paid a commission for every home purchased from the 60 homebuilders that use his platform. They include Toll Brothers, Highland Homes and Historymaker Homes. The platform has allowed the Dallas native to rake up sales from the comfort of his DFW office.

In 2023, The Real Deal ranked him fourth among the top resi brokers in Houston. He closed 291 sales in Greater Houston, with a combined value of $159 million.

Caballero’s platform continued to pump out sales, even as resi markets across the state faltered. Production homebuilders, ever focused on balance sheets, frequently revised sale and production targets. While sales look to be returning somewhat, the market is far from its 2021 heyday.

Caballero sat down with TRD to discuss his rise to the top, the biggest challenges facing the industry and whether he even considers himself a broker anymore. The conversation has been edited for length and clarity.

How do you think copycat NAR lawsuits could affect the Texas resi market? Would it affect HomesUSA?

I haven’t really been able to come up with a scenario that could affect us very much. In fact, it might help us, because there could wind up being fewer agents, and the business and compensation could change. It’s just really too early to tell. But then the other thing is, everybody may be banking on it getting reversed on appeal. If it does not, it could very well bankrupt NAR, and that would be kind of a Wild Wild West here, with MLS, with no centralized trade association. It could have benefits for the buyers and sellers, but it could create some chaos in the real estate business and make the competition more prevalent than it already is.

Do you have a preferred outcome post-Sitzer/Burnett?

I think that the commission is too high. At the same time, I get why there’s tremendous resistance, because there are so many agents in NAR. There are about 1.3 million, and that’s not counting agents who aren’t members of NAR. Yet we’re only selling about 5 million homes a year, which means the average agent is selling less than five homes a year. Even though the commissions are high, they’re not making very much money. There are a lot of agents starving to death now, so lowering their commissions is kind of difficult to accept.

Working with home builders across Texas gives you a unique view of the state. What’s your best market?

Houston and Dallas are neck-and-neck a lot of the time. They are building pretty much the same product. I would say that Houston is much more of a risk-taker’s market. The builders there are very aggressive in their business practices.

The entire Texas market is great for me — I would not be as successful if I were anywhere else. I’m in the most productive state as far as new home construction. That’s a big part of my success: the Texas market.

How does the Houston market stand out?

Master-planned communities. They constitute a significant portion of the sales. I’d say it’s well over 50 percent. Those types of communities are very preferable for the production builders. With the amount of land that they have, they can provide homes on a fairly inexpensive cost-per-home basis. Also, when you are 30 miles from downtown, or whatever, you need to have your own culture and environment, and these master-planned communities offer that.

You’re one of the most prolific agents in the country. How do you sell so many homes?

We’ve been doing over 6,000 sales a year. We list more than that, but sometimes builders will cancel the listing for some reason. There are about 30 of us, but that includes administrators and IT workers. We don’t have agents at HomesUSA, per se. My team operates essentially as MLS-authorized assistants for me to do a lot of this sophisticated data management for our homebuilders.

How did the business grow?

Many builders just don’t have the time or resources or even know-how to do some of these things. The production builders needed what we have, but their production dollars are insulated, and so are the decision-makers. Production builders are very cost-conscious. They’ll change something to save a dime. It took awhile to convince them. Over the years, their attitude gradually changed to really appreciate Realtors, and we benefited from that. They’ve found that builders sell more homes with us than they do any other way.

You have a unique operation. Do you still view yourself as a broker?

I came to the realization about 10 years ago that I was as much a technology company as I was a real estate company. And I can’t really say that about other brokers. I operate as a technology-based, B2B company, and [brokers] are like B2C companies that serve a different market and a different type of customer with different tools. That’s the differentiation. I need all the brokers and agents that are out there to get their buyers to buy my clients’ homes.

What keeps you motivated?

I don’t have to do this, you know. I’m in my ’80s. I could retire, but I love what I do. I get a lot of satisfaction out of doing something that helps my industry. The thought that we’re able to do something that helps so many people is very rewarding.

What’s your forecast for Texas’ resi market in 2024?

I usually use the last four months of the year to give an insight into the following year, because that is the cyclical downturn. We’ve had a good last four months. That means we’re gonna have a good 2024. We are suffering much less than any other area that I know of, except for areas in Florida. Our prices are going more sideways or slightly down, but I think that’s largely been seasonal.

Days on market are going down, except in Dallas. Prices are going up, except in San Antonio. And active listings are going down. Of course, things like war and interest rates could change that. War creates uncertainty, as do election years. Hopefully, those don’t impede indicators that we’re going to have a really good market in 2024. All things considered, Texas is set to do very, very well.

Read more

Ranking Houston’s top resi brokers in 2023

Ranking Houston’s top resi brokers in 2023

Jury finds NAR, brokerages guilty in landmark commissions suit

Jury finds NAR, brokerages guilty in landmark commissions suit

NAR copycat lawsuit adds Texas targets

NAR copycat lawsuit adds Texas targets