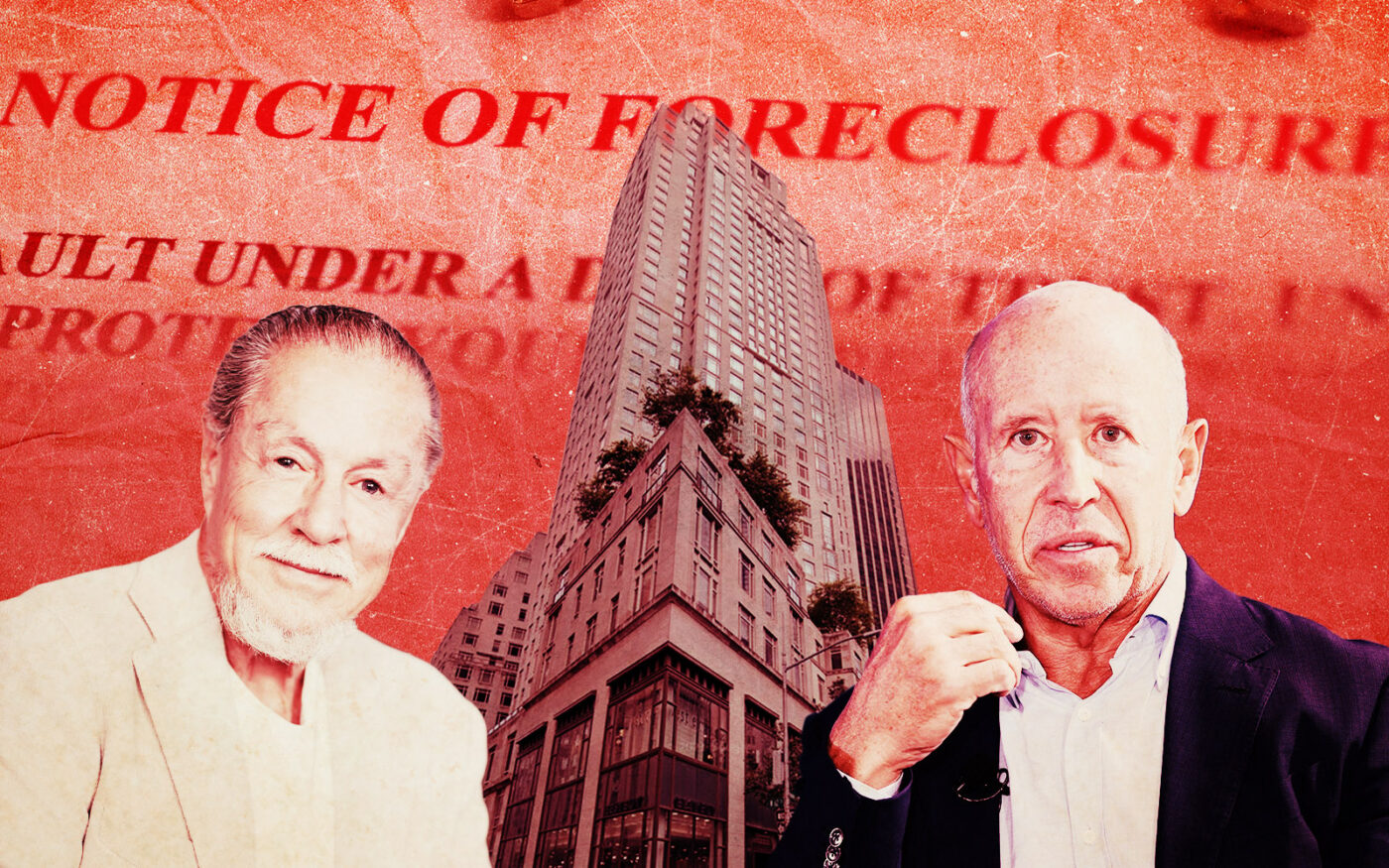

Eyal Ofer, Zeckendorfs face foreclosure on 15 CPW retail

Eyal Ofer, Zeckendorfs face foreclosure on 15 CPW retail

Trending

Barry Sternlicht’s LNR forecloses on “Limestone Jesus” retail condo

Special servicer tees 1880 Broadway commercial condo up for sale

Barry Sternlicht has teed up the struggling “Limestone Jesus” retail condo for a new owner.

Starwood Property Trust’s special servicing arm, LNR Partners, won its foreclosure case in August against the commercial condo at 1880 Broadway, the retail component of the fabled 15 Central Park West condo building.

The property is owned by a partnership of billionaire Eyal Ofer’s Global Holdings, the Zeckendorfs, Fortress Investment Group and Madison Capital.

LNR is now looking to sell the defaulted $125 million loan on the property, which would give the buyer a short path to taking over the property.

The loan is expected to trade at a significant discount to the face value, according to a source familiar with the offering. If a new buyer comes in with a lower basis, it could help alleviate some of the problems the property’s experienced since one of its big tenants closed down in 2022.

A representative for LNR did not respond to a request for comment and a spokesperson for Global Holdings declined to comment. A Newmark team led by Adam Spies and Adam Doneger is marketing the debt for sale.

Global Holdings co-developed the retail space at 1880 Broadway and the 231 residential condos at 15 Central Park West in 2008 with the Zeckendorfs and Goldman Sachs’ Whitehall Funds. Fortress Investment Group and Madison Capital later came on as investors.

The owners refinanced the 85,000-square-foot retail condo on the side of the building opposite Central Park in 2012 with a $125 million loan that Morgan Stanley later sold off into a $1 billion CMBS package.

The property was fully leased at the time, with Best Buy occupying the most desirable space at the corner of Broadway and West 62nd Street. The electronics retailer was the largest tenant, with West Elm, a Chase bank branch and the candy store IT’SUGAR filling out the rest of the spaces.

The loan was set to mature in September 2022 and it was clear there would be a problem. Best Buy’s lease was expiring in January, and the retailer decided not to renew and closed up shop. That left the retail component with a 33 percent vacancy.

The loan was transferred to LNR’s special servicing department, which filed to foreclose in August 2022. The judge in the case approved LNR’s motion to foreclose one year later, which makes it easier for whoever purchases the debt to take over the property and try to fill the vacant space.

That could be just what the property needs. With the $125 million loan hanging over their head, Ofer and his partners didn’t have much room to go out and offer an enticing rent to draw in a tenant.

If the loan sells for a deep enough discount, the new owner would be able to reset rents and make a better push to fill the space.

Read more

Eyal Ofer, Zeckendorfs face foreclosure on 15 CPW retail

Eyal Ofer, Zeckendorfs face foreclosure on 15 CPW retail

"Limestone Jesus" 15 CPW is New York's top-performing condo tower: report

"Limestone Jesus" 15 CPW is New York's top-performing condo tower: report

Frontier pays $18M for Best Buy-anchored shopping center in Kendall

Frontier pays $18M for Best Buy-anchored shopping center in Kendall