Highgate and Flynn Properties buy SF’s Huntington Hotel on Nob Hill

Highgate and Flynn Properties buy SF’s Huntington Hotel on Nob Hill

Trending

Mortgage deadlines loom for dozens of SF hotels

Region’s slow tourism rebound results in daily room rate of $234 below 2019 levels

San Francisco, home to an expected $725 million loan default on two of its largest hotels, has dozens of hotel owners facing mortgage deadlines.

More than 30 additional San Francisco hotels must deal with loans due in the next two years, the San Francisco Chronicle reported, citing a CoStar expert on hospitality.

The city has one of the slowest pandemic rebounds in the nation, and its average daily hotel room rate of $234 in the past year falls below 2019 levels, according to Emmy Hise, senior director of hospitality analytics at CoStar.

Every other U.S. market is above pre-pandemic levels, in part because of inflation.

The Bay Area fallout includes a plan by Park Hotels & Resorts to stop making payments on its $725 million loan for the 1,921-room Hilton San Francisco Union Square and the 1,024-room Parc 55 San Francisco — which means handing the keys to the lender.

Other San Francisco hotels, including the historic Huntington Hotel on Nob Hill and Yotel on Market Street, were recently sold in foreclosure auctions.

Higher interest rates make it tougher for owners facing mortgage deadlines to refinance.

The next big mortgage deadline comes in January, when a $97 million loan matures for the 544-room Hilton San Francisco Financial District on Kearny Street.

As of March, $9.3 million of the loan has been paid off, according to filings by owner Portsmouth Square, a unit of InterGroup, based in Los Angeles.

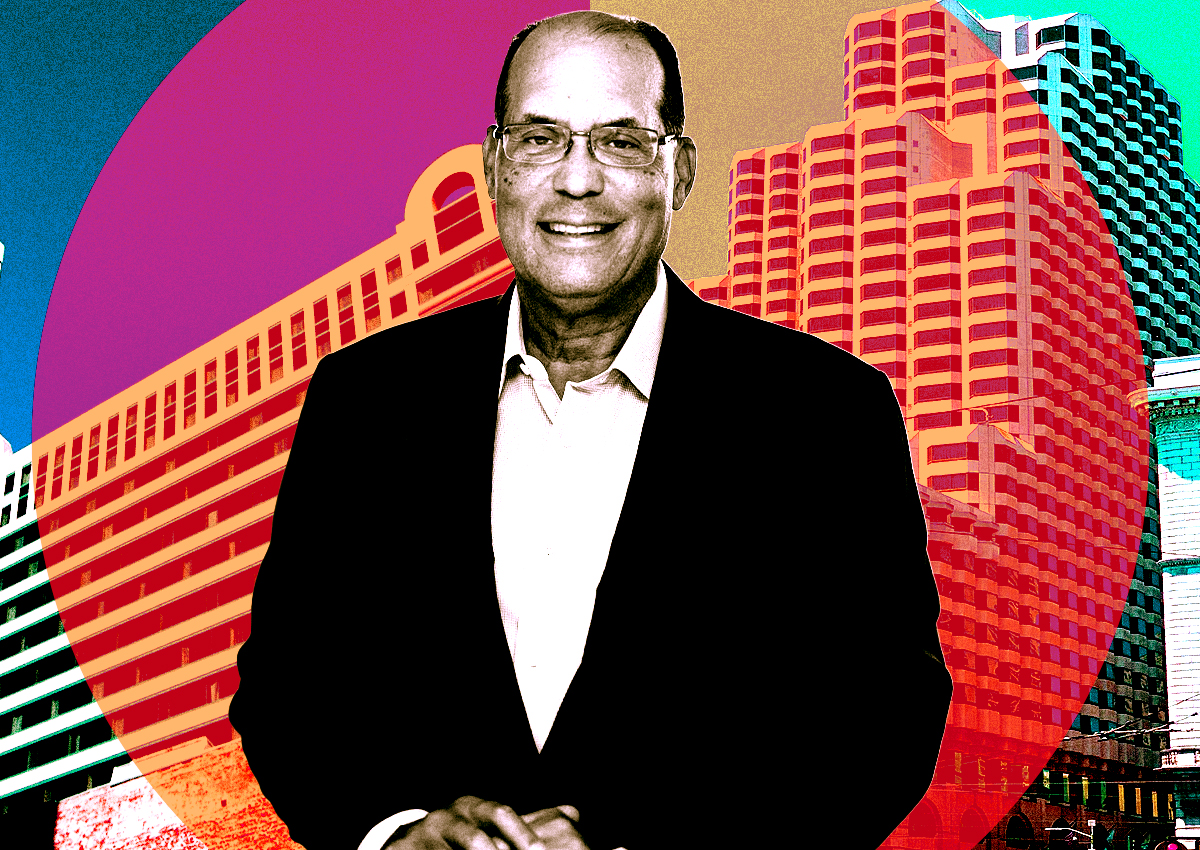

“We are confident that we can achieve the refinancing of this loan,” David Gonzalez, president of Portsmouth Square, told the Chronicle, adding that business has been strong and the hotel has done better than its neighbors.

Gonzalez said the hotel’s presence in the Financial District next to Chinatown, compared to the Park Hotels’ proximity to the Tenderloin, “makes a world of difference.”

The Hilton Financial District hotel was 78 percent occupied in the first quarter, with an average daily rate of $234. The hotel had a $680,000 loss, compared with a $2.47 million loss a year earlier. Minus depreciation and amortization costs of $693,000, Gonzalez said, the hotel was profitable.

— Dana Bartholomew

Read more

Highgate and Flynn Properties buy SF’s Huntington Hotel on Nob Hill

Highgate and Flynn Properties buy SF’s Huntington Hotel on Nob Hill

SF’s biggest hotels to stop mortgage payments

SF’s biggest hotels to stop mortgage payments

Auto Draft

Auto Draft