Trending

City takes aim at controversial property seizure program

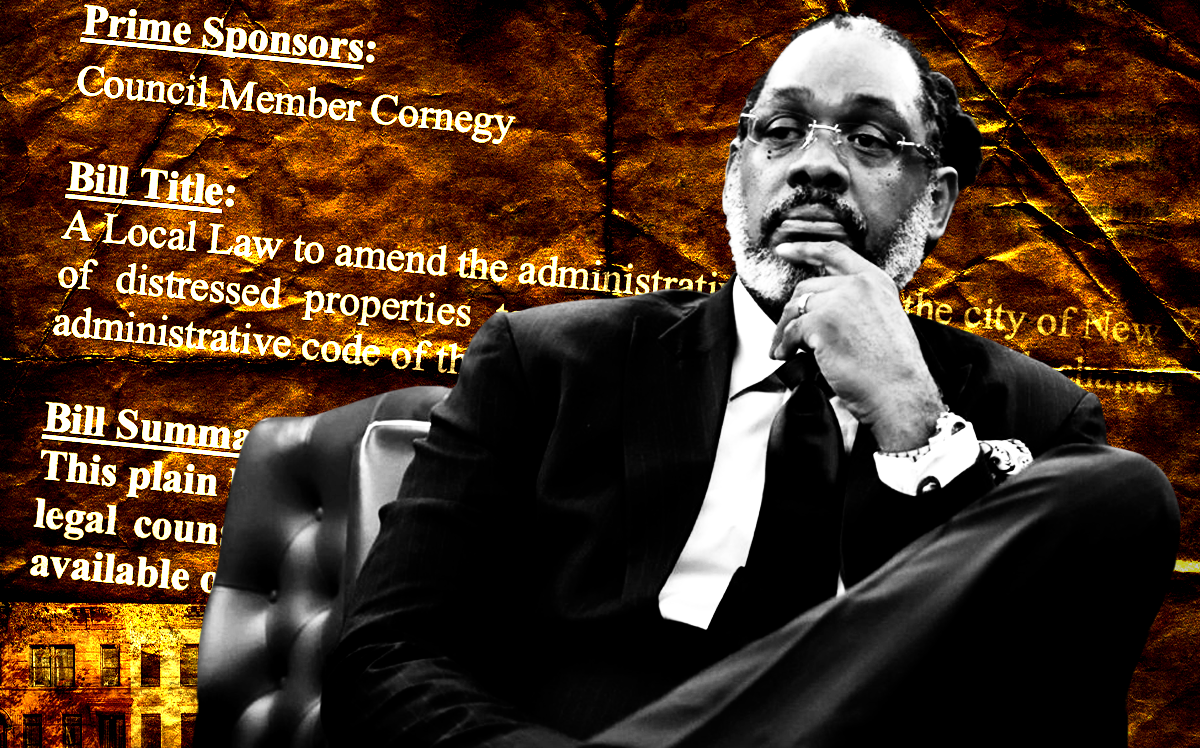

City Council mulls changes to third-party transfer program, criticized for targeting minority communities

The city is considering a series of changes to a controversial program that transfers distressed multifamily properties to developers.

Under the third-party transfer program, the city identifies apartment buildings with outstanding tax debt and hazardous violations and sells them to approved nonprofits and developers to create and maintain affordable housing.

The program has been criticized for disproportionately affecting homeowners of color and has been the subject of litigation involving low- to mid-income co-ops unable to keep up with back taxes or utility costs.

Council member Robert Cornegy will introduce a bill Wednesday that would replace the city’s program with another that has different definitions for “distressed.” For example, the measure sets new thresholds for the number of open hazardous violations that would qualify a building as distressed based on its number of units.

The proposal would also provide more options for owners to avoid having the city seize their properties and would exempt some owners, including those that own one- to three-unit properties or condo units and consider those properties to be their primary residence.

A separate bill, sponsored by Council member Fernando Cabrera, would require the Department of Housing Preservation and Development to add community land trusts to the list of developers eligible to take over properties.

On Monday, a city working group released recommendations for the program, including adjusting payment plan options for owners, increasing outreach to owners before the city initiates foreclosures and creating an “Owner Resource Center” to provide technical and financial support.

The group also considered other changes. Among the options that garnered the most support was a proposal to eliminate the program’s so-called “block pick-up requirement,” under which certain properties on the same block as one that is part of the third-party transfer program must then also be included in the program.

The group voiced support for reconfiguring eligibility requirements based on the individual annual tax liability of each property; a property would qualify when it owes more than one year’s worth of taxes (or three years, depending on the building type), rather than once it has owed taxes for one year. Such changes would also prioritize safety issues over financial obligations when determining whether a property is in crisis.

The working group also favored exemptions for owners of one- to three- family homes who are receiving tax benefits reserved for senior citizens, and suggested the city look into including community land trusts in the program, as Cabrera proposes. It also supported giving Housing Development Fund Corporation cooperatives, or HDFCs, the opportunity to return to the shared equity form of ownership after the property is transferred.

During a hearing by the City Council’s Committee on Housing and Buildings Tuesday, Elizabeth Oakley, a deputy commissioner of development at HPD, said the agency supported the working group’s recommendations but was still reviewing Cornegy’s measure.

She noted that HPD has some concern that the bill would “lead to selection of properties not appropriate for the program,” with insignificant tax debt, and that increased requirements to notify owners would be “practically infeasible.”

The third-party transfer program, created in 1996, is intended to take properties in disrepair off the hands of owners who can no longer afford to adequately ensure tenants’ safety. In January 2019, the de Blasio administration announced plans to potentially expand the city’s seizure authority, focusing on the “worst of the worst landlords with hazardous conditions that are not addressed.”

It targets buildings that are not eligible for the city’s annual lien sale, and like that program, has come under fire in recent years for disproportionately affecting owners traditionally denied opportunities to build wealth. Another task force is studying potential reforms to the lien sale, which is slated for Dec. 17 following several postponements during the pandemic.