It’s back: Lawmakers propose ban on broker fees

It’s back: Lawmakers propose ban on broker fees

Trending

New York pols revive push to kill broker fees

Reform floated as fees surpass $10,000

New York’s on-again, off-again relationship with broker’s fees may be headed toward another breakup.

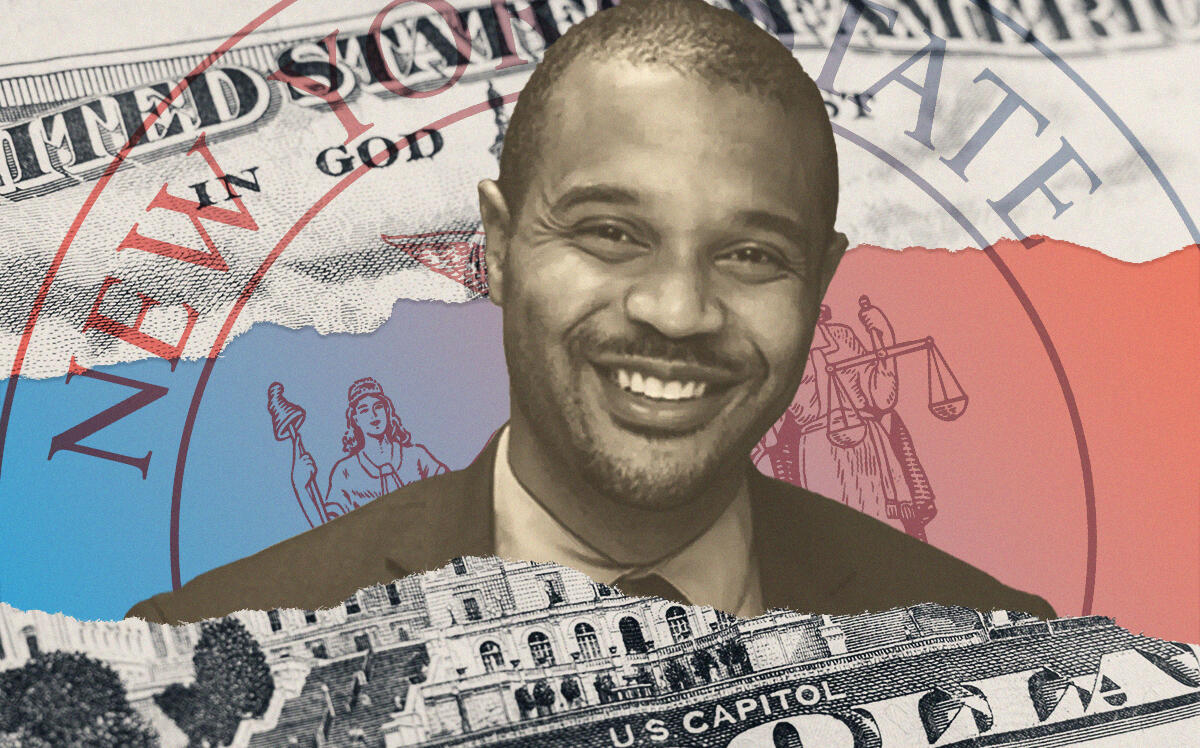

New York Sen. Jabari Brisport broached the issue in a Thursday morning tweet:

“Tenants should not pay brokers fees,” he wrote. “The landlord hires the broker. The landlord should pay the broker.”

“[Assembly member Zohran Mamdani] and I have a bill for this,” Brisport concluded. The lawmakers are two of a handful in the state legislature who are affiliated with the Democratic Socialists of America.

The renewed interest in broker fees by state legislators and City Councilwoman Carlina Rivera, according to Gothamist, comes as New York rents have broken records for each of the past six months.

In response to that supercharged demand, brokers are pushing the envelope to see what tenants are willing to pay. Jaw-dropping fees for rent-stabilized units, for which landlords cannot charge market-rate rents, have made headlines this summer.

Read more

It’s back: Lawmakers propose ban on broker fees

It’s back: Lawmakers propose ban on broker fees

Broker fee ban an “error,” court rules

Broker fee ban an “error,” court rules

Landlords, not tenants, must pay rental broker fees: state

Landlords, not tenants, must pay rental broker fees: state

In June, Hellgate reported that an Upper East Side walk-up was charging a $10,000 fee to rent a two-bedroom listed for $3,150 per month.

And last month, a City Wide Apartments broker caught the eyes of the Department of State after asking an extra $20,000 for a stabilized one-bedroom on the Upper West Side.

Typically, brokers charge between one month’s rent and 15 percent of the annual rent. When demand is low, as they were in 2020, no-fee apartments become easier to find.

But the five-figure charges reek of “key money” — illegal fees landlords charge tenants to secure a lease. Some have suggested that with fees as high as they are, brokers may be kicking back a portion of them to landlords.

Bisport’s bill seeks to cut the cord between tenant and broker altogether.

The state senator’s legislation, introduced and co-sponsored by Sen. Julia Salazar in April 2021, would make it illegal for landlords to demand any payment at the beginning of a tenancy, apart from the $20 allotted for application processing. That includes broker fees. It’s unclear how much traction that bill might get now that fees appear to be rising.

The hotly contested legality of broker fees was settled just last year. After the 2019 rent law imposed the $20 cap on application fees, the Department of State issued guidance in February 2020 that brokers who accept tenant-paid fees could be subject to discipline.

Within days, brokerages and landlord groups, including The Real Estate Board of New York, sought a temporary injunction against the guidance. The industry prevailed in April of that year when an Albany judge put broker fees back on the table.

Bisport responded with his bill less than two weeks later. But given the state of New York’s rental market at the time, fees had become a non-issue.

In the spring of 2021, New York rents and apartment demand were just beginning to recover from the pandemic and most units were listed without fees.

Even now, with the market having roared back, tenant leaders such as the Met Council on Housing’s Andrea Shapiro acknowledge that exorbitant charges haven’t been a primary concern.

Bisport told Gothamist that tenant-friendly lawmakers have had bigger fish to fry, notably attempting to enact good cause eviction.

Brokers’ pushback against fee bans have emphasized that most brokers are middle-class New Yorkers and would see their incomes drop if landlords were forbidden to require tenants to pay broker fees.

The industry has also claimed that if passing along broker fees were banned, landlords would instead raise rents — eliminating any savings for tenants and potentially costing them more in years to come.