Over the glut, but now what? Breaking down NYC's new condo inventory

Over the glut, but now what? Breaking down NYC's new condo inventory

Trending

New development deals roar back to life in August

After an abysmal July, contract signings at the city’s new projects shot up

The new development market has roared back to life since suffering its worst month of the year in July, according to a report from Marketproof.

New developments notched 259 signed contracts last month for apartments asking a combined $527 million. The median unit price fell 12 percent to $1.45 million, as outer-borough deals made up a bigger piece of the action.

All told, contract activity jumped 35 percent month-over-month and aggregate dollar volume increased 17 percent. Buildings completed in the past eight months performed particularly well as resale inventory remained low.

“The new development market is better than you think,” said Marketproof CEO Kael Goodman.

Read more

Over the glut, but now what? Breaking down NYC's new condo inventory

Over the glut, but now what? Breaking down NYC's new condo inventory

Bob Knakal lists Park Avenue pad for $13M

Bob Knakal lists Park Avenue pad for $13M

Manhattan’s builders landed 117 contracts for units asking $340.6 million. That’s a 33 percent increase in contract volume from August 2019. As activity surged, the median asking price dropped to $1.9 million, a 23 percent dip from the previous month.

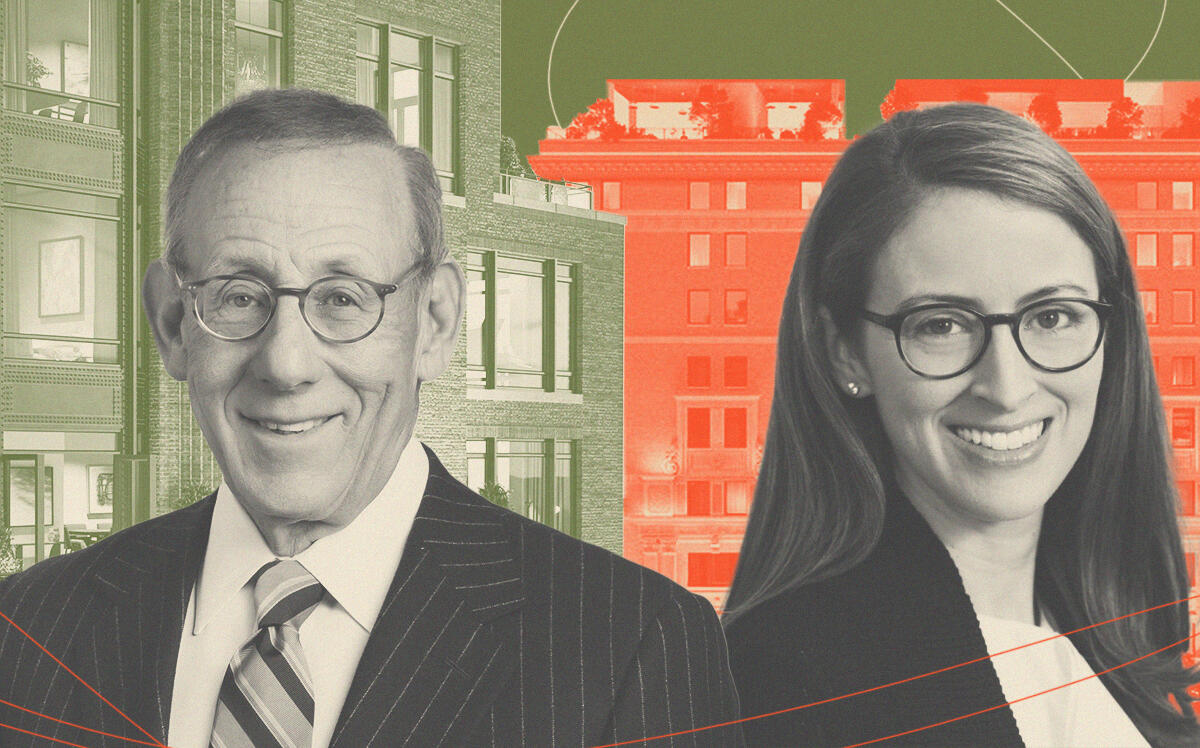

The Cortland and 208 Delancey were the borough’s top two performers by volume, selling eight apartments apiece. Top contract honors went to The Cortland, developed by Related Companies and Mitsui Fudosan America, which pulled in the top two deals: a three-bedroom asking $17.5 million and a five-bedroom asking $16.6 million.

Brooklyn new developments stabilized after an abysmal July. The borough’s 110 contracts in August represented a 57 percent leap from the previous month and put it back on par with pre-pandemic levels for this time of year.

Median prices rose 28 percent to $1.26 million. One Prospect Park West, developed by Sugar Hill Capital Partners, scored Brooklyn’s top contract last month with a four-bedroom last asking $4.5 million. Regular top performer Olympia Dumbo nabbed the second-highest contract by asking price, while a unit at Extell Development’s Brooklyn Point commanded the highest price per square foot of the three.