Todd rips into Texas leaders on state park

Todd rips into Texas leaders on state park

Trending

Could new blood end eminent domain brawl over $1 billion development?

Parks and Wildlife Commission chair steps away, commission expects to stay the course

As soon as Dallas developer Shawn Todd bought a massive development site that includes Fairfield Lake State Park, the state tried to take it from him.

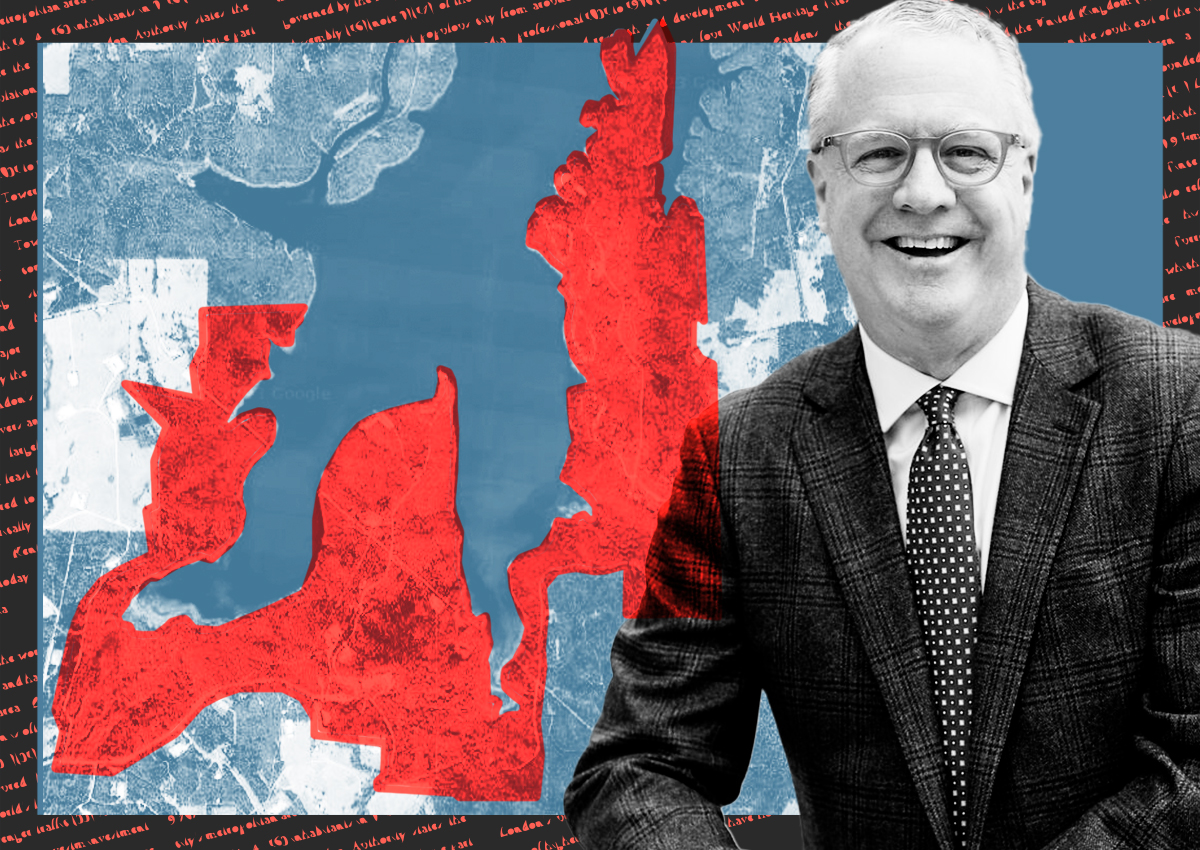

In June, Todd’s firm, Todd Interests, purchased roughly 5,000 acres of land and a manmade lake 90 miles south of Dallas for $110 million. The developer plans to turn the expanse into a $1 billion luxury resort with 400 homes and a golf course designed by star golf architect Beau Welling. But the state, which has leased 1,800 acres of the land as a park for about 50 years, isn’t ready to say goodbye.

A day after Todd Interests closed on the property, the Texas Parks and Wildlife Commission voted unanimously to take the land by eminent domain. Since then, it’s been a scorching summer of counter-offers, legal threats and scathing editorials. Meanwhile, Todd has started building his resort.

The latest twist in the narrative came late last week when the Parks and Wildlife Commission announced that Arch “Beaver” Aplin III, the commission’s chairman and the founder of Buc-ee’s, would be leaving his post. He will be replaced by Jeffery Hildebrand, an oil and gas executive. Aplin has led the eminent domain charge for Fairfield Lake, calling it a “treasured state park” in an op-ed defending the decision.

Aplin’s departure could have signaled a shift in the state’s eminent domain decision, but on Monday, it told TRD that the leadership change did not mean the department would adjust its course.

“We don’t have any reason to anticipate that incoming-Chairman Hildebrand would change direction,” said Cory Chandler, a spokesperson for the parks and wildlife department.

Todd says he’s holding out hope that Hildebrand will step back from the eminent domain claim. “I feel like past leadership has put Parks staff in a corner,” Todd said. “I believe that Jeff Hildebrand will be a breath of fresh air.”

The Parks and Wildlife Department has emphasized that it considers this a unique situation. “This rare activation of eminent domain authority is a last resort to save an existing state park that Texans have enjoyed for the past 50 years,” Aplin wrote in the op-ed. Hildebrand has noted that the commission has not used its eminent domain power in nearly 40 years.

The commission even voted to limit future uses of eminent domain to “exceptional and unusual circumstances,” but it has done little to put Texans anxious to protect private property rights at ease.

If the state wants to use private land for a public purpose but the owner refuses to sell, it has the authority to force the sale. Texas would need to pay Todd “just compensation,” but it isn’t easy to determine a fair price for land in Texas, where sale prices are rarely disclosed.

To proceed, the Parks and Wildlife Commission would have to formally condemn the land, a two-step process in which commissioners appointed by the court set a fair price for the land and the parties enter litigation. If they don’t settle, it can go to trial, possibly before a jury.

The full story is a yearslong yarn that would need much more time to explain, but here’s the outline of how we got where we are. Earlier this year, with Todd Interests under contract to buy the 5,000 acres for around $110 million, the state offered just $60 million, plus a tax incentive. It asked Todd to be “altruistic” and walk away, expenses paid, later offering a fee of up to 6 percent of the value of the deal.

Todd countered with an offer to sell the state the 1,800 acres of parkland, minus the lake’s valuable water rights and a carveout that covered some walking trails, for $60 million. Parks was unwilling to part with the walking trails and the deal fell through, the Dallas Morning News reported.

On the same day Todd closed on the property, the state sent previous owner Vistra Energy an offer to buy the property for $95 million, while offering Todd up to $25 million in fees.

Last week, Todd said he had rejected the state’s final offer for the property. The state also told Todd it had appraised the property at $85 million, setting the price he would receive if it follows through with the eminent domain process, Todd said.

In the most recent legislative session, the state gave the parks and wildlife commission $125 million to buy property in 2024 and 2025. Fairfield Lake State Park saw about 82,500 visitors last year, less than 1 percent of the roughly 9.5 million visitors to all Texas state parks that year. Todd says the price of the land would make it an unwise purchase, given the park’s relatively low attendance.

“Jeff Hildebrand is a brilliant businessman. I don’t think he’d spend 100 percent of his capital budget on an opportunity that would generate less than 1 percent of his revenue,” Todd said.

While the state, Todd and Vistra butted heads behind the scenes, bills in the Texas House of Representatives and Senate that would have used eminent domain to condemn the park land died in committee. Even though the legislature’s session has ended, Todd’s political woes aren’t over.

On Wednesday, State Sen. Lois Kolkhorst wrote an editorial calling for more scrutiny on Todd’s project, particularly its funding.

“This is not a simple debate over the public or private use of pristine Texas lands,” Kolkhorst wrote. “There are real concerns being raised that deserve answers regarding who exactly is behind the funding Todd Interests used to purchase these thousands of acres of park land and water resources.”

She specifically called out CMB Infrastructure Investment Group, which gave Todd Interests a $92 million loan for the deal. CMB operates EB-5 vehicles, which allow foreign investors to obtain Green Cards in return for certain investments.

In the most recent legislative session, Kolkhorst sponsored a bill to ban land purchases by dual citizens of or businesses associated with China, Iran, North Korea or Russia. While the language in the bill was toned down before it was passed, Kolkhorst has made foreign land purchases a hobby horse after a Xinjiang-based real estate tycoon bought a 140,000-acre wind farm in Del Rio.

Todd says he has no foreign investors in the project.

Read more

Todd rips into Texas leaders on state park

Todd rips into Texas leaders on state park

Todd Interests battles for State Park

Todd Interests battles for State Park

Todd Interests to develop luxury homes on state park, GOP protests

Todd Interests to develop luxury homes on state park, GOP protests

“I think I could relieve Senator Kolkhorst of her self-imposed anxiety if she had had the courtesy to call me and ask if we have any foreign investors,” he said. “We have no foreign investors in our partnership or entity.”

“CMB regional centers is an Illinois-based company that has been in existence for over 20 years, and one of their largest customers is one of America’s greatest patriots, Ross Perot and Hillwood,” he added.

Across the country, politicians and developers are mortal frenemies. They need each other for permits, donations, housing and economic development. They are also perpetual thorns in each others’ sides.

But the Fairfield Lake fight is no standard development battle: one of the most conservative state governments in the country is moving to force a sale of a massive, privately owned development site. Who had that on their Bingo card?