Trending

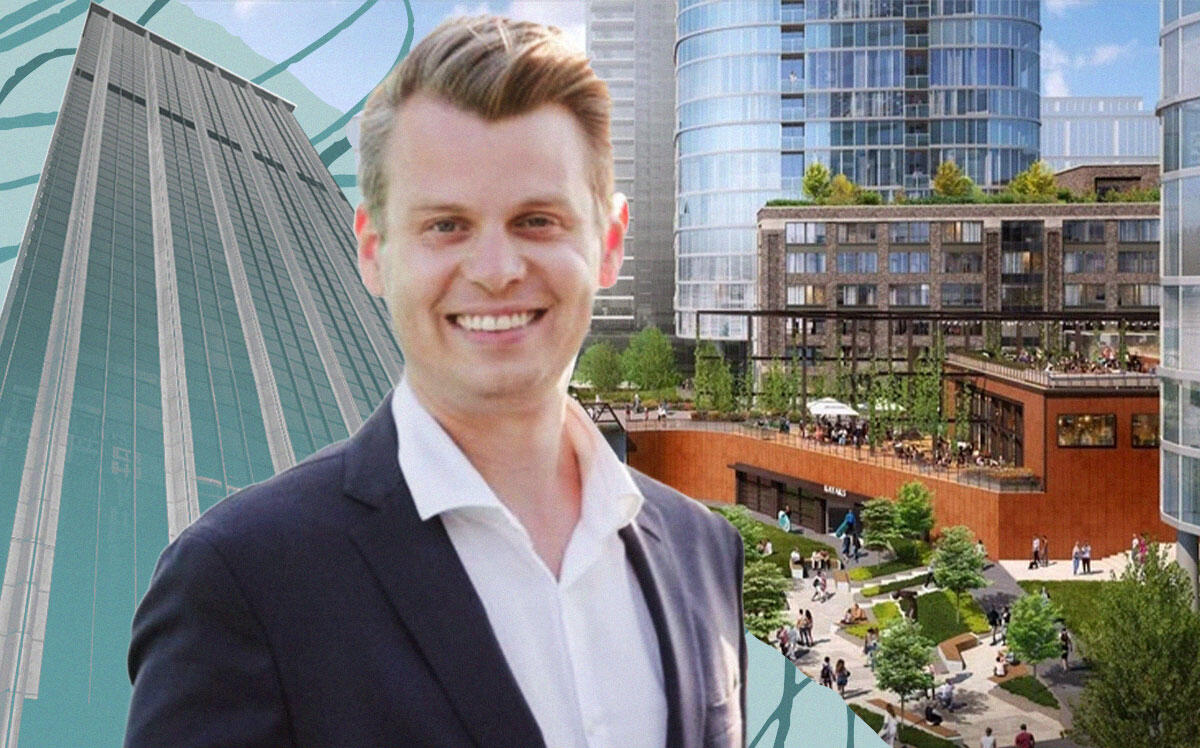

Chicago’s high property taxes, pandemic don’t deter Onni Group’s $1B investment in downtown development

Onni plans mixed-use complex featuring 2,700 apartments, revamp of vacant 31-story office building in the Loop

A Canadian real estate company is spending $1 billion on two commercial projects in downtown Chicago, betting that one of the country’s largest office markets will recover from record vacancy rates as it emerges from the pandemic.

Onni Group plans a mixed-use complex with about 2,700 apartments on Goose Island and a revamp of a vacant, 31-story, 853,000-square-foot building at 225 West Randolph Street, which could cost the firm $1 billion combined, Crain’s reported.

“Why wouldn’t you invest here?” said Duncan Wlodarczak, chief of staff at Onni. “It’s one of the greatest cities in the world, it has all the right fundamentals, it has a great workforce population … Chicago is a great long-term bet.”

Founded in the 1990s, the firm owns and operates about 18.4 million square feet in cities across the country, including Seattle, Phoenix, and Los Angeles. Of the total, 20 percent of its projects and properties are in Chicago, including office towers at 200 North LaSalle Street and 550 West Van Buren Street, and a development of a 356-unit apartment building at 369 North Grand Avenue in River North. Onni’s other planned developments include a 373-unit apartment tower in River West and another mixed-use building at 357 North Green Street in Fulton Market.

Few developers have been as bullish about downtown real estate prospects, especially with Cook County Assessor Fritz Kaegi’s move to shift more of the property tax burden to commercial properties, and the uncertainty of post-pandemic demand for workspace in the Loop. For companies that stayed in Chicago, most have been migrating to Fulton Market, leasing fully amenitized buildings in the vibrant neighborhood filled with new restaurants and residential developments.

Wlodarczak thinks otherwise. He points to favorable factors, such as the downtown’s population growth as shown in the 2020 Census and Site Selection magazine’s recent report that the Chicago area drew more corporate relocations last year than any other metropolitan city.

“It’s easy for people to buy into a lot of the negativity,” said Wlodarczak. “But we launched new buildings during the pandemic and people moved in. It just shows that Chicago is incredibly resilient.”

Onni bought an outdated office building at 225 West Randolph Street for $166 million in December and plans to spend about $150 million for renovations and leasings. The firm also paid about $63 million in January for the Ace Hotel in Fulton Market.

[Crain’s] – Connie Kim