Double whammy: Reuben brothers hit with second Century Plaza suit

Double whammy: Reuben brothers hit with second Century Plaza suit

Trending

These savvy investors are set to lose big in the Century Plaza foreclosure

Court documents show ownership behind Michael Rosenfeld’s redevelopment

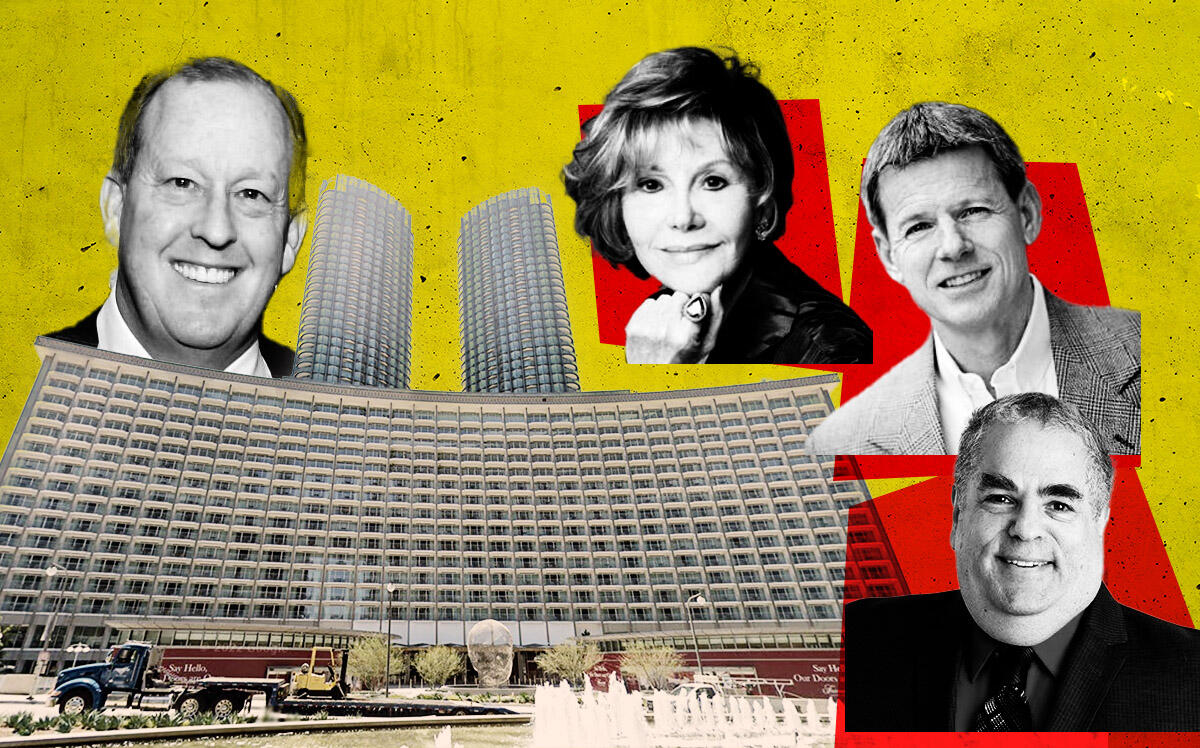

Doug Frye, former CEO of Colliers. Harvey Bookstein, partner at Armanino, the auditor behind collapsed cryptocurrency firm FTX. Glorya Kaufman, the widow of KB Home founder and homebuilder Donald Kaufman.

All three are investors in Michael Rosenfeld’s Century Plaza redevelopment, a $2.5 billion hotel and residential project at 2050 Avenue of the Stars, according to court documents filed in New York.

Frye, Kaufman and Bookstein, and the project’s other investors are now set to lose big, after Rosenfeld defaulted on $1.8 billion worth of loans attached to the development. David and Simon Reuben, the U.K. investors and brothers, have filed to foreclose on the property, and are fighting off lawsuits from mezzanine lender DigitalBridge and a group of EB-5 lenders.

Rosenfeld owns the largest stake in the development, according to an ownership chart filed by the EB-5 lender group.

He owns about 90 percent in two limited liability companies — Eastside Century Partners and Westside Century Partners — that own Next Century Partners, the entity that is the formal owner of the property.

The remaining 10 percent comes from Kaufman, Frye, entities linked to Harvey Bookstein and his wife Harriet, the nonprofit June Foundation and other Delaware-registered limited liability companies.

Kaufman is a philanthropist who has donated to both UCLA and the University of Southern California, which named its school of dance after her. Nonprofit tax returns show her foundation had about $10.4 million in assets as of December 2020.

Kaufman owns about 2 percent of the entire Century City redevelopment. That indicates her stake is worth about $50 million, based on her percentage ownership of the $2.5 billion project, though it’s unclear how much she has invested.

Frye, who served as Colliers’ CEO until 2015 after the firm was spun off from its former parent company FirstService, holds a much smaller stake. He owns less than 1 percent of the development, coming out to a value between $20 million and $25 million. Both Kaufman and Frye are listed by name as investors.

Roughly another 0.5 percent of the project is owned by entities linked to Harvey and Harriet Bookstein, pegging their ownership at $12.5 million. Harvey Bookstein founded accounting firm RBZ, which was acquired by Armamino in 2015. Armamino was recently embroiled in FTX’s fallout, after the firm’s cryptocurrency unit allegedly failed to flag issues at the crypto exchange. The building that houses the business school at California State University — Northridge is named Bookstein Hall in honor of the couple’s donation to the school.

The Los Angeles-based June Foundation also holds about a sixth of a percent of the development, or $15 million. Run by Michael Kest, the firm reported about $19 million worth of assets at the end of 2019, records show.

Other limited liability companies that own stakes in the project include Chelsea Hotel Ventures and Horizon, both of which could not be traced.

All of these investors are set to lose their control in the project, after the foreclosure, which is set to occur next month. While Rosenfeld’s Next Century Partners has not filed for bankruptcy, UCC foreclosures allow mezzanine lenders to bid on the property using their existing debt.

Both DigitalBridge and the EB-5 lenders have alleged in lawsuits that the Reuben brothers spent years reshuffling the debt stack and acquiring a mezzanine stake in the project, so they could take control of the asset and whittle away other debtholder claims.

Both lawsuits, filed in New York, are still pending.

Read more

Double whammy: Reuben brothers hit with second Century Plaza suit

Double whammy: Reuben brothers hit with second Century Plaza suit

Fight or flight: Inside the billion-dollar battle at Rosenfeld's Century Plaza

Fight or flight: Inside the billion-dollar battle at Rosenfeld's Century Plaza