Trending

Back to reality for Miami’s top residential brokers

Agents in TRD's annual ranking ramping up marketing, convincing sellers to cut prices

Like in any great deal, Adrienne Arsht had a combination of good timing and good luck.

The businesswoman and philanthropist listed her bayfront Miami estate for $150 million in January 2021 — double what anyone had paid for a single-family home in Miami-Dade County before.

So when she sold it for $107 million in September to billionaire hedge fund manager Ken Griffin, little attention was paid to the nearly 30 percent discount off the asking price. It still marked a record for Miami-Dade, and it propelled Arsht’s listing agent, longtime Coral Gables broker Ashley Cusack, to the top 10 real estate agents in Miami-Dade County by sales volume.

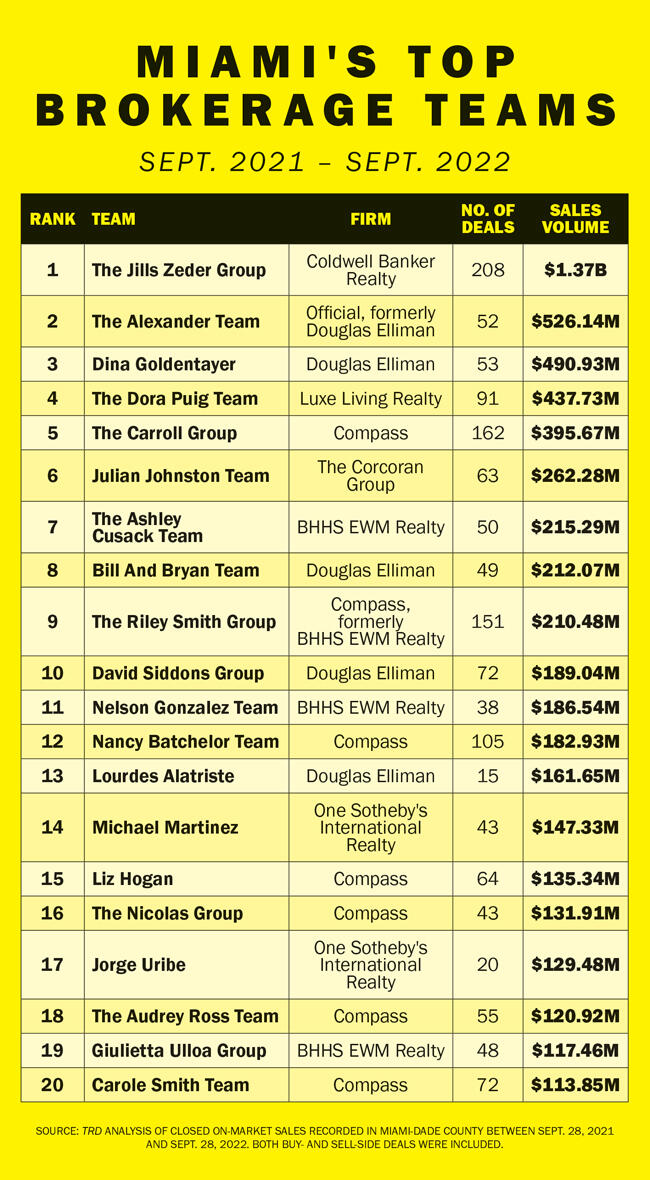

Though the deal was something of an anomaly in a slow period for home sales, South Florida’s top agents still managed to rake it in last year. The region’s top 20 teams closed more than $5.7 billion in sales, according to The Real Deal’s analysis of on-market transactions for the 12-month period ending in late September.

Jill Hertzberg of Coldwell Banker’s Jills Zeder Group, which topped the ranking, represented Griffin in his purchase of Arsht’s estate. The deal was a land acquisition for the billionaire, who is now trying to have a historic home moved off the property.

The Jills Zeder Group closed 208 deals totaling nearly $1.4 billion over the 12 months, according to TRD’s ranking. The mega-team, a coupling of The Jills and The Zeder Team, which joined forces in 2019, is made up of 14 agents, including eight principal agents.

“We were doing deals with them, and we realized geographically that was a brilliant move,” Hertzberg said about the merger, which gives them a major leg up in any ranking. “Everyone [on the team] is powerful and has their own book of business.”

The market has shifted dramatically since then, making the timing of the merger even more auspicious. Many of the team’s deals in the last two years have set local records.

In one of their more expensive transactions, Hertzberg and Judy Zeder represented the seller of a waterfront home in Coral Gables’ Old Cutler Bay that traded in March for $34 million, a record for the community. Oren Alexander, part of the second-ranked Alexander Team that until recently was with Douglas Elliman, represented buyer Michael Dorrell, who founded New York-based Stonepeak Infrastructure Partners.

Weeks later, as the market started to turn, Alexander and his brother Tal would head out on their own.

Energy boost

The Alexanders opened Official, their brokerage backed by white-label firm Side, in June.

“Now, you’ve got to take a step back and you have more of this startup vibe, and everyone is really in it,” said Oren Alexander. “You’re not working for someone else.”

The same month the Alexanders left Elliman, Riley Smith left Berkshire Hathaway HomeServices EWM Realty after 17 years to join Compass.

“I recognized that the market was going to shift, and I was looking for an energy boost for the team,” said Smith, whose team placed ninth on the ranking with $210.5 million in closed sales.

Smith said the market slowdown in July was both a “blessing and a curse,” as it gave him and his team time to acclimate to Compass.

Smith said the market slowdown in July was both a “blessing and a curse,” as it gave him and his team time to acclimate to Compass.

“The fall market never really came back this year. A lot of my colleagues are very doom and gloom,” he said. “I still see the demand. We don’t have the inventory. Once that loosens a little, we should be okay.”

Buyers gain an upper hand

Elliman’s Bill Hernandez noted the change in the market immediately at the start of the summer. The phones stopped ringing. Hernandez and his business partner, Bryan Sereny, called it the slowest summer in their 19-year career.

“It was really odd. When school got out, the light switch turned off,” Hernandez said. “A lot of our sellers were extremely worried.”

Hernandez and Sereny’s team narrowly topped Smith’s for eighth on TRD’s list, closing 49 deals totaling $212 million between September 2021 and September 2022.

Hernandez said it’s important to “really pay attention to the shift in the market and really get sellers to understand we’re not in a pandemic market.” Some listings have “been 30 percent overpriced,” he said.

“Some sellers got too aggressive in what they’re asking. That was a little bit of a turnoff,” said One Sotheby’s International Realty’s Jorge Uribe, who took 17th place with $129.5 million.

“A lot of these sellers hired rookie agents, who told them what they wanted to hear,” he added. “It’s kind of like the blind leading the blind. Sometimes these downturns are better for the business. In a seller’s market, they can hire their cousin.”

Longtime leading broker Dora Puig, owner of Luxe Living Realty, said it’s been tough persuading sellers to come down. Puig, fourth on the ranking with nearly $438 million in dollar volume, said sellers are still tied to comps from the height of the market.

“I am not seeing that many price reductions. I would like to see more,” she said.

Zeder said many buyers are “sitting on the sidelines waiting to see what the correction will be.” Though inventory is ticking up, brokers say much of it isn’t priced correctly.

“There will be price adjustments on properties,” she said. “You can’t keep doubling and doubling in prices. The pace of 2021 was not sustainable.”

Puig recently listed an under-construction waterfront mansion in Miami Beach for $80 million. The seller, a developer, was building it for himself, but decided to list it instead.

Though wealthy buyers are still moving to South Florida, they’re “not going to pay a stupid number,” said Oren Alexander.

“I don’t think everything is going to sell moving forward,” he said. “Taking an $80 million listing of a house that’s unfinished — to me you’re wasting your time, you’re wasting your money.”

Hernandez and Sereny laid some of the blame on the brokers continuing to sell the dream of a profitable flip, even though those days are mostly over. Some buyers from 2020 and 2021 are now sellers, and they’re taking losses.

“We always come in with very realistic numbers,” Sereny said. “We’ll oftentimes walk away. We’re in the business of selling real estate, not collecting listings.”

Elliman’s Dina Goldentayer, who ranked third with about $491 million in dollar volume, agreed.

“There’s no hardship in getting listings right now,” she said. “The hardship is in getting well-priced listings.”

Goldentayer said buyers regained some leverage in the second half of the year and were able to negotiate again. Waived inspections and free leasebacks are a thing of the past.

“Buyers have enough to choose from where they don’t have to buy overpriced, poorly presented product,” she said.

One Sotheby’s International Realty’s Michael Martinez, who is active in Pinecrest, Coral Gables, South Miami and Glenvar Heights, and ranked 14th with $147 million, said sellers will have to adjust.

“Their house might not be the only house the buyer is considering at this time,” he said.

Growing in a downturn

Growing in a downturn

Compass’ Chad Carroll, whose team ranked fifth with nearly $396 million in dollar volume, said he’s now doubling his spending on marketing. He’s still targeting out-of-state buyers.

“We know how to navigate down markets,” he said.

The Carroll Group is also looking to break into new markets, both in South Florida and farther north, and is bringing on “high-powered, seasoned agents to facilitate this expansion.”

Compass’ Smith said he’s also doubling his advertising budget to gain market share. During the Great Recession, he and his wife maxed out their credit cards to grow their business — a bet that ultimately paid off.

“As [listings] start to expire, as people’s cousins and brothers can’t sell anymore, there will be a flight to quality agents,” he said.

Nelson Gonzalez, a longtime broker with Berkshire Hathaway HomeServices EWM Realty, is eyeing an expansion to Palm Beach, where the brokerage recently opened an office.

To attract a new pool of buyers, Gonzalez, who placed 11th with $186.5 million in sales, is doing targeted marketing in Massachusetts after voters there approved a 4 percent “millionaire’s tax” on annual incomes above $1 million.

Corcoran Group’s Julian Johnston, the sixth-ranked broker with $262 million in dollar volume, adjusted his marketing about six months ago to focus more on local buyers. Before, he was advertising heavily in New York and Los Angeles.

Puig, who noted an increase in buyers as of mid-November, said her marketing budget is ramping up “well into the six digits.”

“That’s what listing brokers do. That’s why we’re here to stay,” she said. “In the last year and a half, my marketing budgets weren’t that high because I was selling so fast.”