Trending

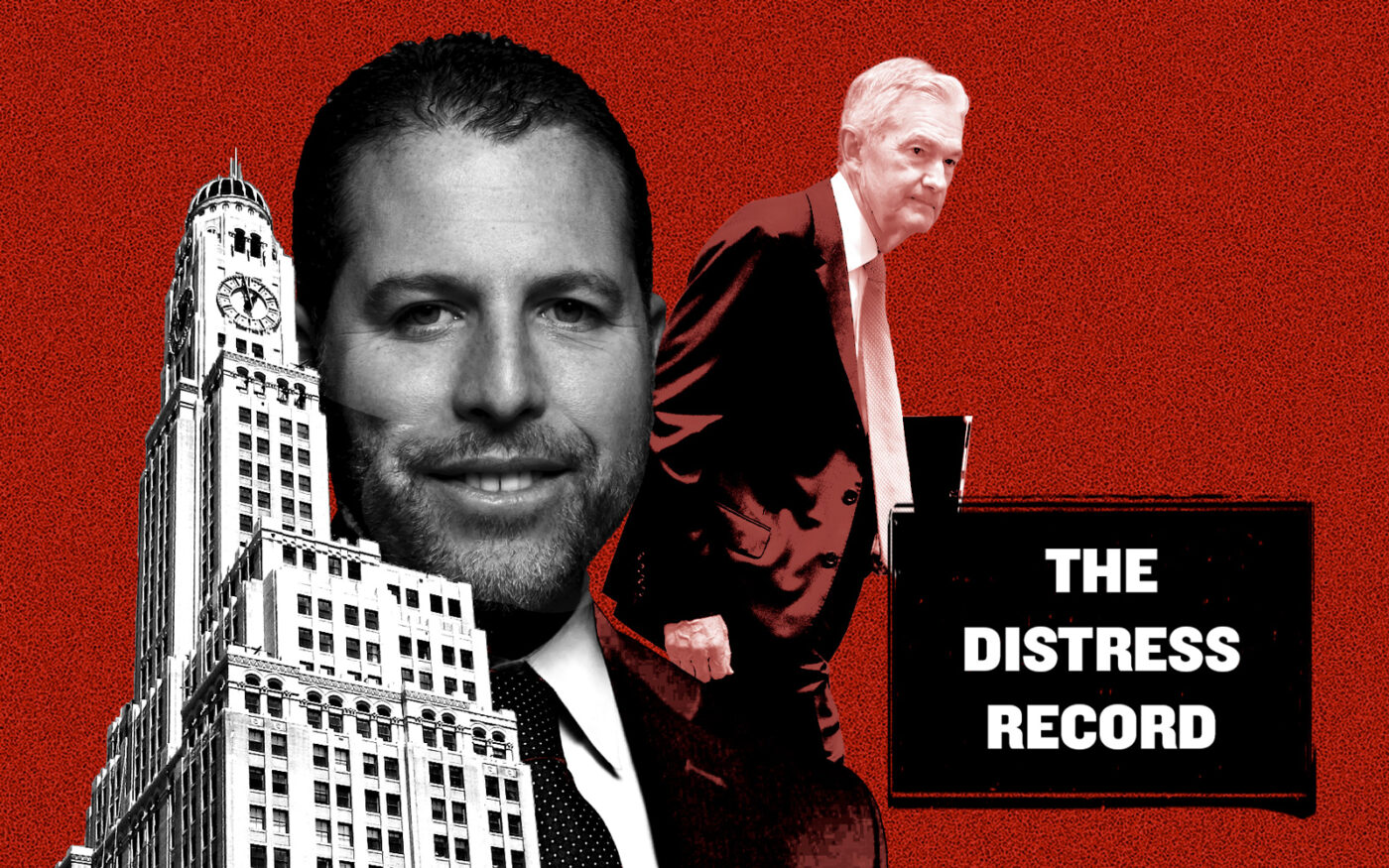

The Distress Record: More trouble for Madison Realty, Siguler Guff, Highgate

NYC tower heads to foreclosure as the Fed predicts more office distress in 2024

The New Year has kicked off with more bad news for commercial real estate, and without any visible light at the end of the tunnel.

Indeed, last week the Fed noted “continued weakness” in the office sector, according to minutes from the central bank’s meeting last month, which was first reported by Crain’s.

Policymakers cited the pipeline of distress still to come in the sector, saying “the large volume of loans scheduled to mature over the next few quarters suggested that delinquencies would likely surge again.”

Banks hold roughly $3 trillion worth of debt across the commercial sector, according to the Congressional Research Service.

In New York, the retail portion of the Williamsburgh Savings Bank Tower is heading to a foreclosure auction within 90 days.

The 41,400-square-foot property is to be sold almost three years after lender Amherst Capital brought a foreclosure action against its owner, a joint venture between Madison Realty Capital and private equity firm Siguler Guff.

In February, a judge allowed the lender to move ahead. Madison Realty principals Brian Shatz and Josh Zegen were personally on the hook for some of the debt because of guarantees in the loan documents.

Last week, the judge finalized the foreclosure judgment, calculating the amount owed on the loan at $23.8 million along with default interest.

A date has not been set for the auction.

In San Francisco, Highgate Hotels missed a balloon payment on about $250 million in debt attached to the Hyatt Regency Downtown SOMA, according to loan documents and special servicer commentary cited by Trepp.

The missed payment comes about a year after the completion of a $70 million renovation of the 686-room hotel. The New York City-based hospitality property owner was up to date on its payments until last month, when the loan came due.

It bought the hotel for $315 million at the end of 2018. At the time, the property at 50 Third Street was known as the Park Central Hotel, the same name as an NYC property that Morgan Stanley-owned Highgate also bought for $366 million.

In Houston, Harris County has acquired a mostly empty downtown office building, shedding light on the bottom of a market that’s also facing mounting distress.

The county paid $26 million for the 20-story building at 1010 Lamar Street, which is 80 percent vacant and foreclosed on. The price comes to about $86 per square foot.

Elsewhere in the news

Landlords across LA county saw leasing fall 28 percent to 2.2 million square feet in the fourth quarter, down from 3 million square feet in the prior period.

Brookfield DTLA towers lead SoCal’s largest loan defaults of 2023

Fifty years ago, the Community Preservation Corporation stepped in to save NYC’s aging affordable housing. Now, with the help of Related Fund Management, it’s trying again.