Trending

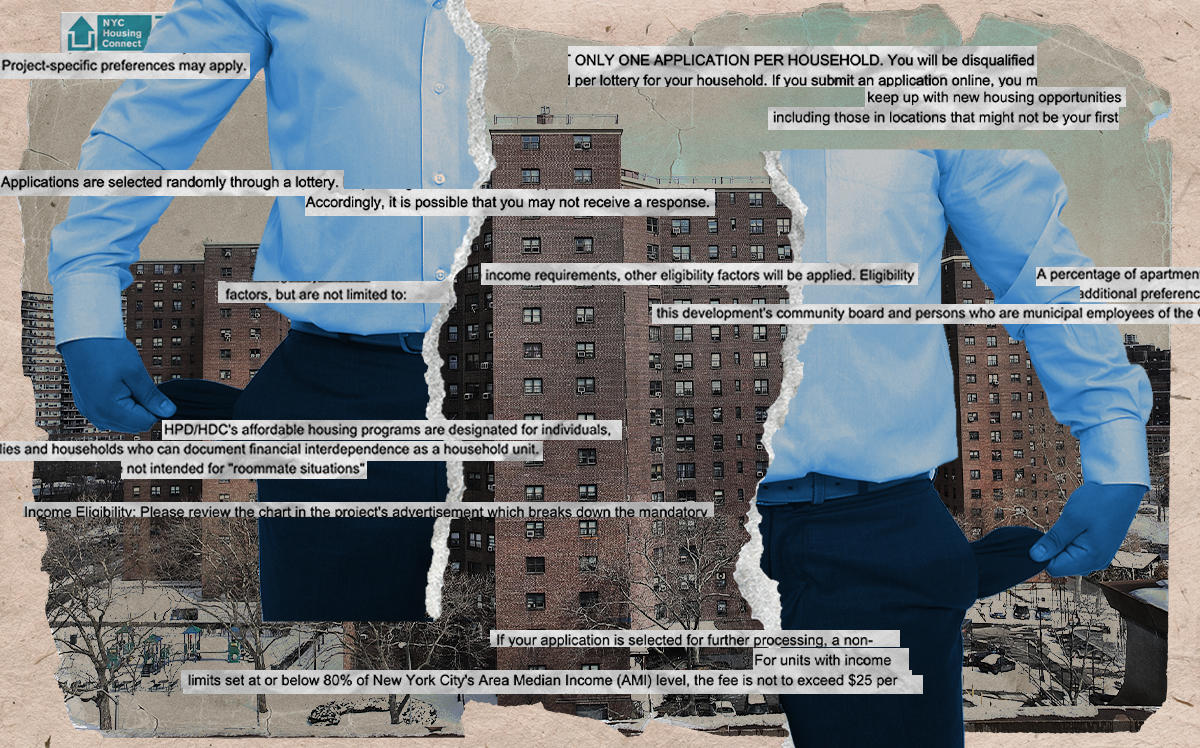

Poorest face worst odds in city’s housing lotteries

Competition is stiffest among those who need the most-subsidized apartments

If it’s lonely at the top, it’s lonelier at the bottom for those seeking affordable housing.

The less money you earn, the less likely you are to be chosen in New York City’s housing lottery, according to an analysis of 18 million applications by The City.

Even before Mayor Bill de Blasio’s proposed cuts to the city’s capital budget — which will mean a loss of 21,000 affordable apartments over the next few years — demand at extremely low income levels, defined as up to $30,720 for a family of three, is not matched by supply, which prioritizes homes for low-income earners making $51,201 to $81,920.

For every extremely low–income unit lottery, the NYC Housing Connect system received 650 eligible applications; for each low-income home, the system received 354.

The city has just fixed another problem with the process: lottery applicants applying for homes they do not qualify for, which Margy Brown, associate commissioner of Housing Preservation and Development, called “the reply-all phenomenon.”

Applicants would “go through and just click apply, apply, apply to every lottery,” even if they didn’t fit the criteria, she told The City. HPD’s new system, Housing Connect 2.0, only accepts applicants whose household and income sizes match the development where they seek an apartment.

That technical fix, however, won’t address the root of the problem: Not nearly enough heavily subsidized units for the number of people who need them.

To ensure that projects are financially viable, the city does not require developers to include many apartments for extremely low–income households in their projects.

“By using those higher-income units, you subsidize the lower-income ones,” Jessica Katz, executive director of the Citizens Housing and Planning Council, told The City. “The demand is always going to be greater at the lower end of the spectrum.”

The City found, as one would expect, that interest in units set aside for higher-income households attract less interest the more expensive they are. A handful of projects’ “affordable” units were so expensive that no lottery “winners” rented them.

Before the pandemic devastated tax revenued, the de Blasio administration did increase funding for low-income and extremely low–income renters, so one quarter of new homes would be for those earning less than $30,000 per year and half for families earning under $50,000. [The City] — Orion Jones