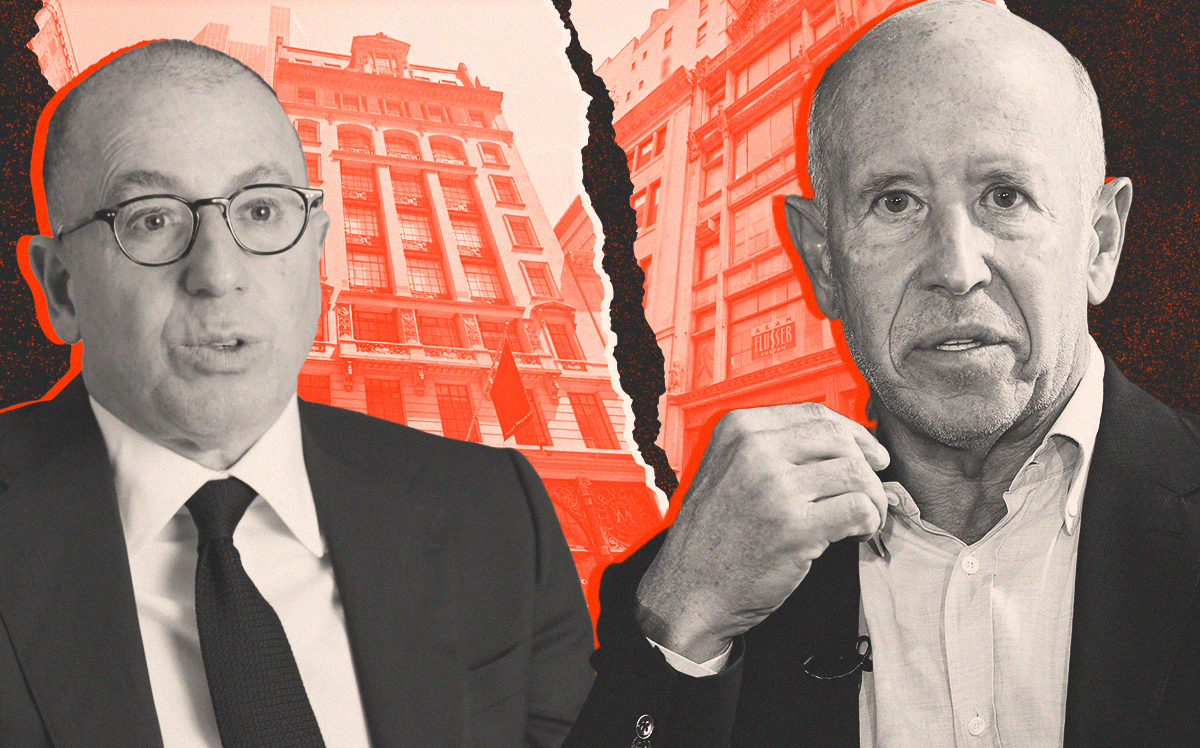

Joe Sitt’s Thor Equities faces foreclosure on Meatpacking property

Trending

Sternlicht’s LNR eyes foreclosure of Thor Midtown properties

Joe Sitt’s firm allegedly defaulted on $105 million loan

Barry Sternlicht is coming for two more pieces of Joe Sitt’s Manhattan real estate.

Starwood Capital Group’s special servicing arm LNR Partners and Wilmington Trust, acting as a trustee for CMBS bondholders, filed a pre-foreclosure action last week against Thor Equities’ 597-599 Fifth Avenue and 3 East 48th Street over a $105 million CMBS loan that Sitt and his real estate firm allegedly defaulted on more than two years ago.

In the complaint, first reported by PincusCo, LNR and Wilmington Trust ask the court for permission to sell the adjacent mixed-use Midtown properties and to order Thor to make good on the $124 million it owed as of December. The sum includes loan payments, accrued and unpaid interest, late charges and other fees.

The lender had been pursuing both foreclosure and receivership proceedings while discussing possible alternatives with Thor, according to an SEC filing in December.

In 2014, UBS provided Thor with the $105 million loan, which consolidated debt on the properties. Sitt, Thor’s founder and chairman, signed a non-recourse guaranty on the loan, and the note was assigned to the CMBS trust and Wilmington as the trustee that same year.

After Thor allegedly missed multiple monthly payments, the real estate firm and its lender reached a loan modification agreement in May 2020 that deferred interest payments and reserve deposits. Thor agreed to make the deferred payments over a 12-month period from July 2020 through June 2021.

However, Thor allegedly stopped making monthly payments again in August 2020 and every month thereafter, putting the loan back into default. Thor was notified that fall that the loan had gone into special servicing.

Since then, Thor has allegedly failed to make good on its debt, and the servicer rejected its attempt to pay off part of the loan at a discount. The outstanding principal, interest and other costs are now due in full, according to the complaint.

Thor, LNR and attorneys representing the plaintiffs had yet to respond when reached for comment.

LNR replaced Midland Loan Services, a division of PNC Bank, as the loan’s special servicer this past fall.

Sternlicht’s pre-foreclosure filing comes four months after LNR acquired Thor’s distressed retail property at 470 Broadway in Soho for $25 million.

Thor acquired the 12-story 597-599 Fifth Avenue and the six-story 3 East 48th Street in 2011 for $108.5 million from A&A Acquisitions.