Trending

Waldorf Astoria condos to hit an oversupplied market this fall

Douglas Elliman will market the 375 apartments

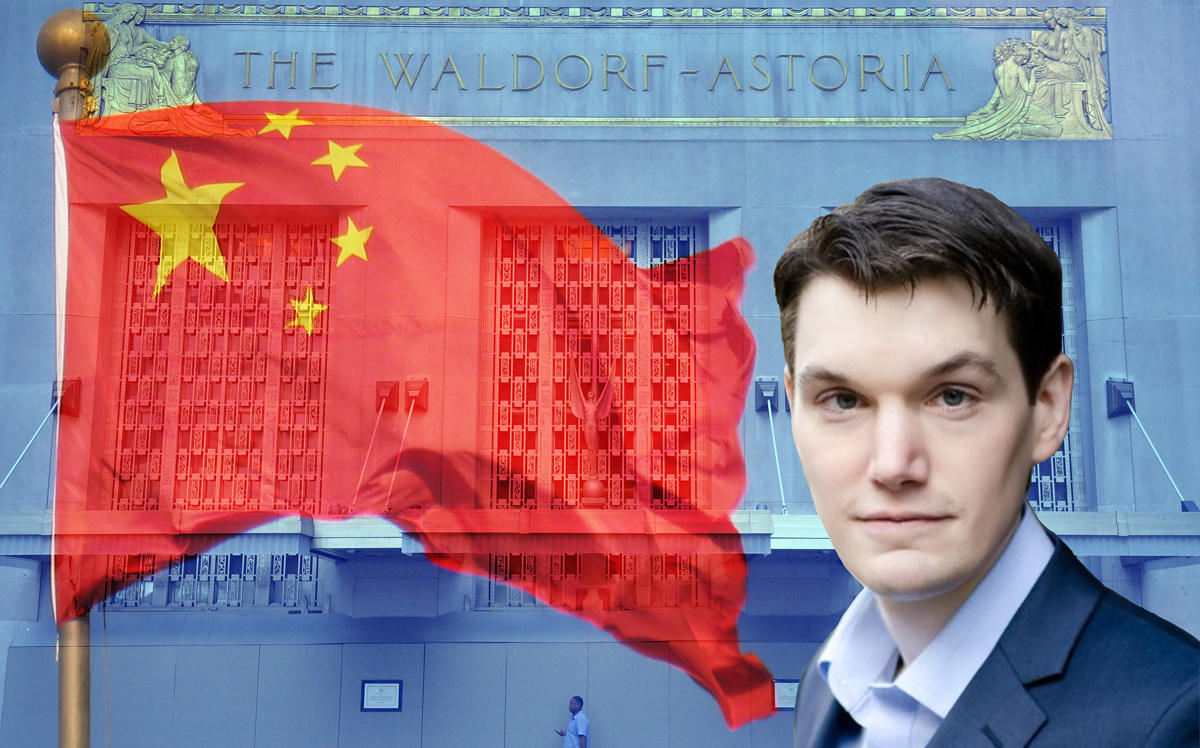

Despite a soft condominium market and a tense political atmosphere, Anbang Insurance Group is moving ahead with plans for its luxury condos at the Waldorf Astoria, which are set to hit the market this fall.

The Beijing-based conglomerate, currently under Chinese government control, has hired Douglas Elliman Real Estate to sell the 375 apartments at the redeveloped hotel, the Wall Street Journal reported. The brokerage is also working with London-based Knight Frank Residential to find overseas buyers.

“It’s a chance to own a piece of New York history and all the stories that go with it,” Douglas Elliman Development Marketing CEO Susan de França told the Journal. “Its uniqueness puts us in a class of our own and the wide array of unit sizes and types opens up the universe of buyers”

Anbang bought the historic hotel at 301 Park Avenue from Hilton Worldwide Holdings for $1.95 billion in 2015, a record price for an American hotel. Hilton will continue to manage the converted residences and the downsized hotel, which was closed in 2017 and is expected to reopen in 2021.

The China Insurance Regulatory Commission took control of Anbang and all of its assets last February, following suspected illegal activity at the company. Anbang’s former chairman, Wu Xiaohui, was sentenced to 18 years in prison last May after being convicted of orchestrating a $12 billion fraud.

In additional to continued oversupply in the New York luxury condo market, ongoing U.S.-China trade tensions may present further challenges for sales at a Chinese government-controlled property, which has already raised national security concerns.

Though Douglas Elliman declined to discuss pricing for the apartments, other brokers told the Journal that prices would likely reach $3,500 per square foot or more, among the city’s priciest. [WSJ] — Kevin Sun