Trending

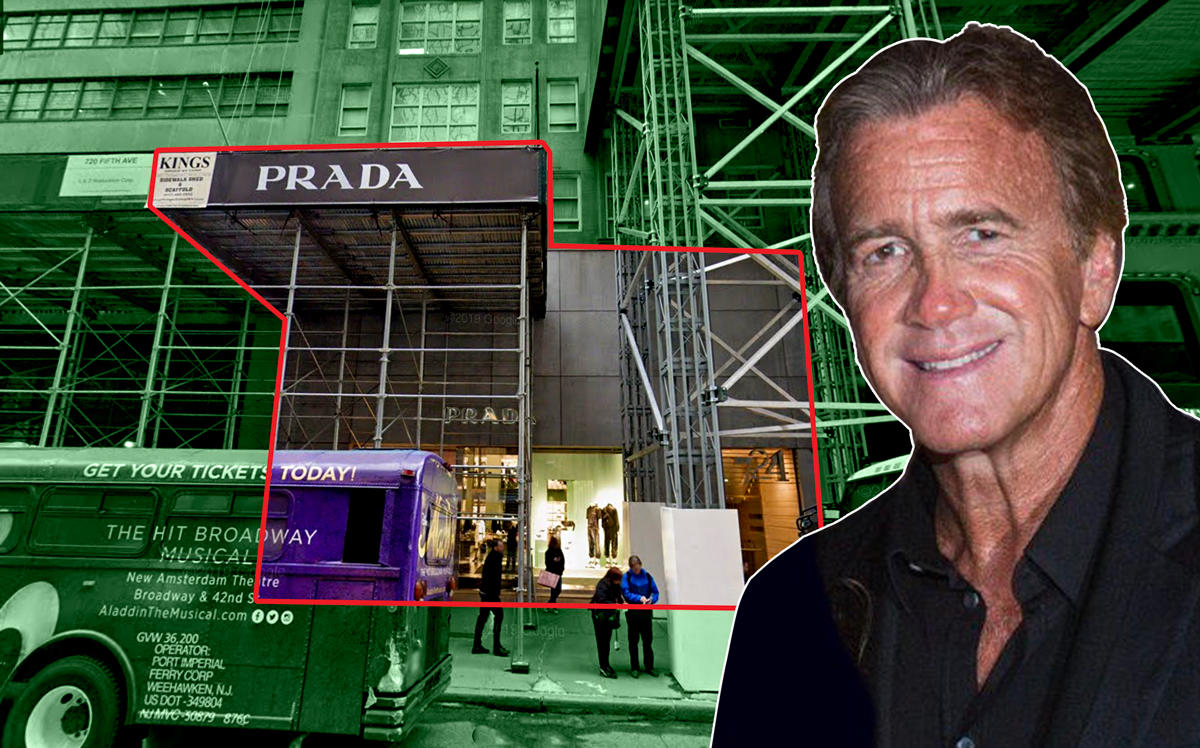

Prada gives landlord Jeff Sutton a lawsuit for Christmas

Suit claims Wharton Properties can't undo decision to have retailer vacate NYC flagship

Six years ago, Jeff Sutton told Prada that he intended to renovate the building that houses the luxury fashion giant’s flagship, 724 Fifth Avenue.

The parties struck a deal, according to a lawsuit Prada filed on Christmas Eve in Manhattan: Prada would temporarily leave — with a year’s notice from Sutton’s Wharton Properties — while the landlord undertook the work. Sutton also was to pay Prada $5 million and post a $25 million letter of credit.

The lawsuit claims that after giving a 2020 deadline for Prada to temporarily relocate, Sutton is allegedly trying to back out and won’t remove scaffolding on neighboring 720 Fifth Avenue that is harming Prada’s business. Prada, which had taken steps to vacate its store, wants Sutton to suspend the lease as planned and pay the $5 million.

The fashion retailer declined to comment. Sutton also did not comment.

The lawsuit comes as retail tenants around the city grapple with rising rents and landlords have to contend with filling vacant space.

Sutton and asset-management giant Brookfield also own the commercial portion of the Crown Building, at 730 Fifth Avenue, which sits on the other side of Prada. The upper levels of that property are undergoing a conversion into luxury condominiums.

According to Prada’s lawsuit, in December 2018 Sutton sent it a notice saying Prada’s lease would be temporarily suspended on March 12, 2020. That’s when Prada, which pays $22 million a year in rent, began preparing to move to a temporary location nearby.

But in October, five months before the suspension date, Sutton allegedly told his tenant that he was withdrawing the suspension as he “apparently no longer wanted to redevelop the building — or at least not on the originally proposed timetable,” according to the filing, which adds that Prada’s deal with Sutton allows him a “single” option to suspend the lease.

“No portion of the lease authorized any such withdrawal, and established law holds that an option, once exercised, is binding upon the option holder,” Prada’s suit says. Yet Sutton insisted he “could freely exercise an option and withdraw it, repeatedly,” which is contradicted by the lease and “is otherwise nonsensical as it would create an untenable situation for the operation of any retailer’s business.”

After Prada and Sutton disagreed over whether Sutton could revoke his ability to pause Prada’s lease, Sutton allegedly refused to take down “obtrusive and ugly scaffolding” that Sutton had erected on the property next door, 720 Fifth Avenue, which Sutton also owns, according to the complaint.

Prada alleges that the scaffolding, which extends in front of Prada’s store and has led to a loss of sales, is no longer needed, according to the lawsuit.

“The scaffolding remains in front of Prada’s storefront, serving no purpose whatsoever other than to harass Prada and harm its business through the important holiday season,” its case states. The scaffolding primarily affects 720 Fifth Avenue; Prada’s suit doesn’t say why the landlord would want to hurt that building’s tenants, such as Abercrombie and Fitch. The sidewalk shed was erected to protect pedestrians from facade work, according to a Department of Buildings filing from March. But Prada’s suit claims the facade work was completed in October.

Between Nov. 15 and Dec. 31, scaffolding removal is forbidden along that stretch of Fifth Avenue so as not to disrupt holiday shopping, according to one property owner on the corridor.

Prada occupies about 15,500 square feet over four floors in the 12-story building at 724 Fifth Avenue and has office space on the fifth floor. Its lease runs through 2028.

Its lawsuit asks the court to declare that Sutton “was not permitted to withdraw its exercise of the Suspension Option” and that he cannot exercise the option in the future.

The suit could provide the tenant leverage in its negotiations with Sutton. When Prada’s lease was renewed in 2013, it was paying $19 million a year, but as its rent climbed to $22 million, Fifth Avenue and other high-end retail corridors in the city saw their fortunes reverse. But under the terms of the suspension agreement, Prada would have to return and complete the full nine years of the lease, and the rent would continue to escalate during the suspension rather than pick up where it left off when Prada returned, according to a source familiar with the agreement.

Escalating rents and shifts in consumer behavior have led to store closures. In one high-profile example, Barneys New York filed for bankruptcy after landlord Ashkenazy Acquisition Corp. nearly doubled the store’s rent at 660 Madison Avenue to $30 million a year. And Thor Equities has had big problems at some prominent retail buildings.

Wharton Properties took full ownership of 724 Fifth Avenue, which sits between 56th and 57th Streets, in 2018, when SL Green sold its 50 percent stake in the property. Sutton and SL Green had bought the building in 2012.

Write to Mary Diduch at md@therealdeal.com.